Nu Applies for US Bank Charter!

Transformational announcement!

On 24 February 2025, Nu released a video on their YouTube channel where the CEO, David Velez, said the following:

“2025 will be the year when we finally start making the first significant steps towards going beyond Latin America and thinking of the world where Nu is more of a multi-country, multi-region, multi-continental technology company.”

Today, Nu began those first steps of going beyond Latin America by applying for a banking charter in the US!

This is a massive announcement on which the stock should have been up 20%, however, it is flat, likely due to the upcoming US government shutdown.

Let’s analyze this announcement and the implications for Nu.

1. US Banking Charter

2. US Strategy

3. The Potential of the US Market

4. Conclusion

1. US Bank Charter

Yesterday, Nu announced that they have filed an application for a national bank charter with the US Office of the Comptroller of the Currency (OCC).

“Today, our core focus remains on delivering growth in our existing markets, where we continue to see substantial opportunities for expansion. At the same time, applying for a U.S. national charter helps us better serve our existing customers based in the country and, in the future, connect with those who share similar financial needs and could benefit from our products and services,” said David Vélez, founder and CEO of Nu Holdings.

OCC is a US Federal Agency under the Department of the Treasury that is responsible for reviewing and approving national bank charter applications and regulating national banks. Essentially, this means that Nu is applying to have operations in all the US states, without the need to receive a separate license in each state.

The US banking system is very complex and heavily regulated, so this is likely the first step of many for Nu to become a fully-fledged US bank!

The application triggers many actions, and it will likely be years before Nu begins serving customers in the US.

1. Formal application intake – OCC has 120 days to review the application and determine if all the necessary documents have been submitted.

2. Review – Once OCC determines that all required documents are submitted and they are complete and accurate, they will begin the review process. This is the longest step and could take many months or even a year. OCC staff will review the management team, financial projections, business plan, operational risks, capital adequacy, compliance readiness, governance, cyber risk, literally everything you can think of. Furthermore, they have a right to request additional supplemental information, and external reviewers or interagency staff may get involved.

3. Preliminary approval – OCC will first grant a preliminary approval that outlines many conditions that must be met before the final approval, such as depositing capital and meeting other regulations.

4. Final approval – Once all preconditions are met, OCC will issue Nu a banking charter.

With a banking charter, Nu is allowed to issue debit and credit cards, loans, and certain other services, but it is not allowed to take bank deposits.

If Nu wants to collect deposits from customers, it must apply for a license with the Federal Deposit Insurance Corporation (FDIC), and this will likely take another year or two. Sometimes banks apply for both simultaneously, but I don’t think that is the case today, as Nu would have mentioned the FDIC application in the announcement if they had applied for it.

So it could be that once Nu receives the bank charter, it partners with an FDIC-licensed bank, which handles the deposits on behalf of Nu’s customers. This is actually how many fintechs offer interest rates on the deposits. The partner bank pays out the interest to Nu, which it then gives to its depositors.

While there is a chance of Nu’s applications getting denied, I find that unlikely for the following reasons.

· Nu’s Standing – Nu is not some tiny, no-name fintech, they are a $77B corporation with over 110M customers. They have the finances to fully capitalize a new bank and hire the best lawyers, lobbyists, and specialists.

· Strong Team – Nu has assembled an incredibly strong management team, and OCC will view that positively. Brian Brooks, who worked for OCC, sits on the Nu Bank US board, and so does the ex-president of the Brazilian Central Bank, Roberto Campos Neto.

· Regulatory Experience – Nu is a regulated bank in 3 countries with deep experience in managing difficult regulatory environments. OCC will certainly take that into consideration.

· Focus on Underserved Markets - The OCC’s chartering process will consider Nu’s commitment to financial inclusion. Nubank’s mission to serve the underserved and its history of providing no-fee products align with this regulatory objective.

2. US Strategy

So, Nu will likely receive its US banking charter and begin offering low-cost services to underserved low-income communities, with a special focus on Latin Americans.

While it might seem that everyone in the US has a bank account, that isn’t the case, as an estimated 5M+ adults in the US don’t have one!

While we don’t have detailed research into this, it is likely that the majority of these people are low-income minorities living in states close to the southern border. Many of these customers have heard about Nu, or possibly even have a Nu bank account in Brazil, Mexico, or Colombia.

Once Nu has onboarded this cohort of a few million people (low-income legal Latin American migrants/citizens), they will likely focus on the broader segment of low-income Americans.

Depending on the estimates, up to a quarter of US adults make less than $20K a year!

Large legacy and regional US banks are expensive and offer subpar customer experience. Nu has the chance of repeating the success they are having in Latin America, by onboarding tens of millions of lower-income customers in the US.

This cohort of 60M people is essentially Nu’s TAM in the US!

Nu will likely use the same playbook it used in Latin America in the US to acquire customers.

Cheap Credit Card

No Monthly Fees

High Deposit Interest Rates

Loans

Investing

Crypto

Americans really love their credit cards, but unfortunately, most of them come with monthly fees and high interest rates. The ones that don’t have monthly fees tend to offer lower rewards and higher interest rates.

So Nu will likely offer a $0 fee credit card with industry-leading interest rates and rewards!

Additionally, Nu will not charge various other fees, such as account opening, account maintenance, transaction, ATM, and other fees. This will make their services very attractive for lower-income customers.

Another high-potential area that Nu will undoubtedly tackle is remittances!

It is estimated that migrant workers send around $160B a year back to Latin America, with Mexico being the largest destination, responsible for over $60B. I couldn’t find reliable statistics for the US to Brazil or Colombia, but it is likely also in the billions. Traditional remittance services, such as Western Union, charge obscene fees, while Remitly and Wise fees are very competitive.

Nu could offer remittances at incredibly low prices or even for free between Nu US and Nu Mexico, Brazil, or Colombia!

Such an offer would be a loss leader, but highly synergetic, because it would drive higher activity and payment volumes on both sides of the border. Customers on the US side of the border would be more likely to use US Nu as their primary bank, whilst customers on the other side would spend more and get more loans.

Most importantly, it would be disruptive, completely destroying the business models of legacy remittance providers.

Nu’s low-cost strategy will lead to meaningful losses at the beginning, but as Nu scales, it will aim to repeat what it has done elsewhere.

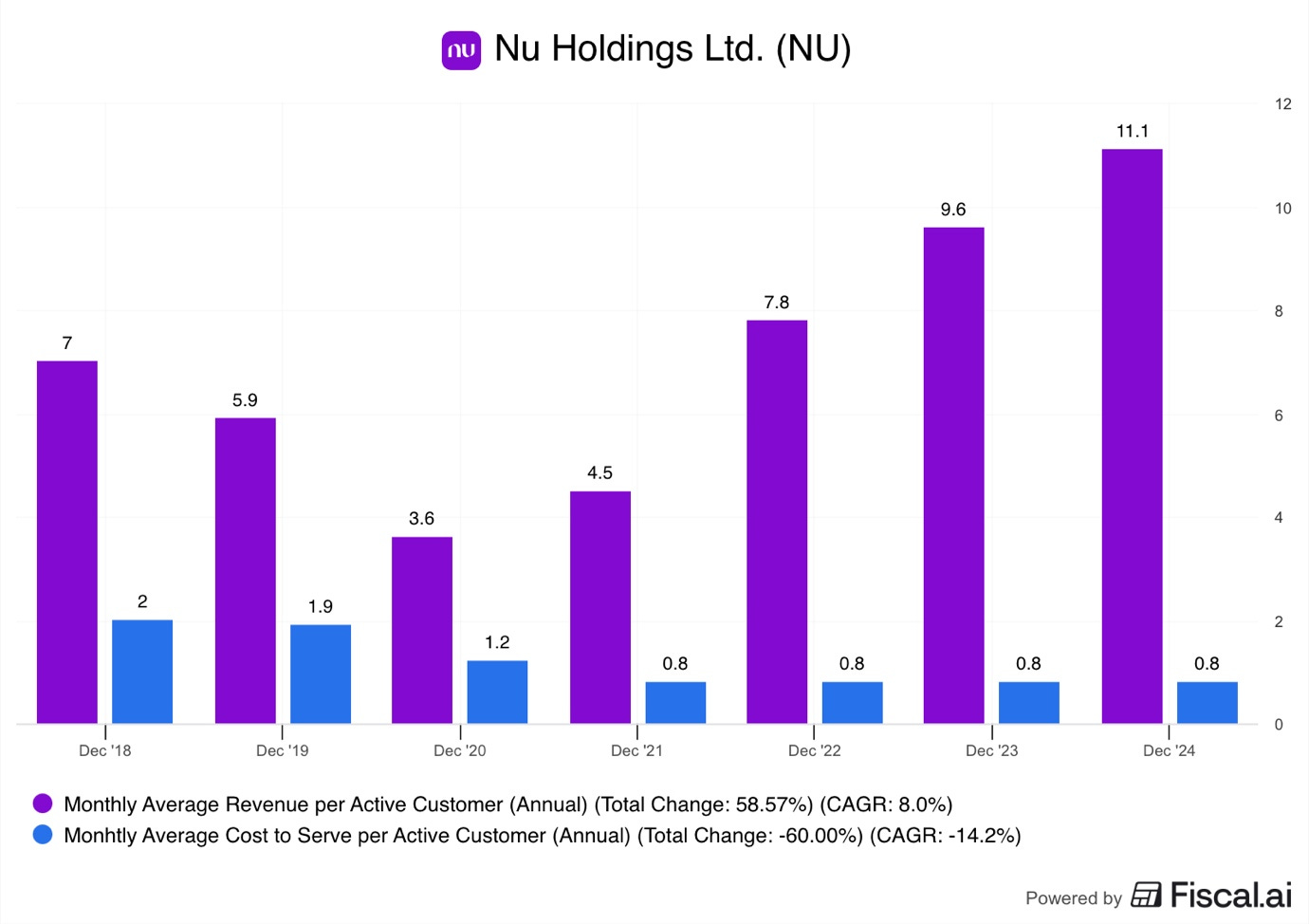

The graph below clearly illustrates this!

Since 2018, the monthly ARPU has increased by 59%, whilst the cost per ARPU is down 60%!

This was achieved because Nu uses the most advanced and latest technology in its business, such as cloud, AI, SaaS, and other automations.

Meanwhile, most legacy banks run on on-premises servers, use core banking based on COBOL software from the last century, and rely on thousands of employees in their daily operations.

This means that Nu has a structural cost advantage over legacy banks and even many US-based fintechs. This advantage will allow them to offer services for prices at which legacy banks can’t make a profit, potentially disrupting the smaller banks that are more exposed to lower-income customers.

3. Potential of the US Market

While the US is a large market, it is very competitive, with many large and established banks and innovative fintechs fighting for market share.

Even if successful, this is not really a 2020s story, but a 2030s!

In the best-case scenario, it will take 2 years before Nu can really begin operations, and even more years before they reach meaningful scale and begin generating any profits. Nu has been in Mexico for over 5 years, and it is still unprofitable today.

But in any case, let’s do some back-of-the-napkin math.

Let’s say that Nu has 10M customers in the US by 2032.

Nu’s current monthly ARPU is $11, so let’s assume that Nu could 7x that in the US, on account of the higher GDP per capita.

That would lead to $770M a month in revenues, or $9.2B a year!

Nu’s 2024 revenue before loan loss provision was $8.7B, so Nu could generate about the same amount of revenue in the US it generates today from 3 countries. Of course, by that time, Nu’s business in Latin America would have grown by many multiples, but the US potential is clear.

However, I think it is a bit premature to adjust Nu’s valuation models as there are too many uncertainties!

It could be that the launch is much slower than expected, or acquiring customers proves to be much more difficult or expensive than expected.

There is also a question of illegal immigrants. As a leading Mexican, Brazilian, and Colombian bank focusing on the low-income people, it likely has tens of thousands of clients who are in the US illegally. This might cause some issues with Republican lawmakers, who might demand that Nu cooperate with the immigration authorities in some manner.

Especially, as legacy banks could lobby hard to prevent Nu from entering the country, as they will have trouble competing. Banking is an incredibly economically powerful and politically connected industry, so they could try to use the illegal immigration argument to slow down Nu’s entry into the market.

In the current political environment, these banks would find many Republican ears willing to listen to them.

4. Conclusion

In conclusion, while this is transformational news that sets Nu up for great things, investors should hold their horses.

This is just the beginning of a long and tedious process!

Firstly, it will take years for regulators to issue the banking charter.

Secondly, after the bank charter, additional regulatory steps will limit what products Nu can offer.

Third, once Nu has received all the licenses, it will take years for them to acquire enough users to reach scale and profitability.

Despite that, this step clearly demonstrates David’s vision and ambition!

They have a clear product and market roadmap to grow the company 10, 15, and maybe even 20x in the next 20 years. They are the leading low-cost digital bank in Latin America, the US is just the next step in this marathon, and other markets will follow.

I have never been so bullish on Nu!

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

This is a gamechanger for Nu, but I think your timeline is actualy conservative. The OCC proces can be brutal and I wouldnt be suprised if it takes 3-4 years before they can really start operations. The illegal immigration angle is interesting, I hadnt thought about that political risk. The remittance play is genius though, capturing that $160B flow between US and LatAm could be huge for engagement on both sides. My concern is customer acquisition cost in the US will be way higher than Brazil or Mexico. Can they really scale profitably in such a competitive market?