Our digitally connected world runs on computers, and computers run on semiconductors. Thanks to these magical, tiny microchips, computers are getting smaller, smarter, and faster. This progress has enabled everything to become a computer.

Your mobile phone is a computer, so is your watch, car, and even some fridges and toasters are computers now!

And no company is manufacturing more semiconductor chips today than Taiwan Semiconductor Manufacturing Company! TSM 0.00%↑

TSMC’s obsessive focus on manufacturing excellence has made them the chip foundry of choice for the most known technology companies of today, such as Apple, Microsoft, Nvidia, AMD, Google, and Amazon.

Semiconductor chips have become the bedrock of our modern digital economies!

It is almost certain that the device you are reading this article from contains semiconductor chips made by TSMC!

Operational excellence has resulted in financial excellence, with sales and profits more than doubling since 2020!

In this article, I will present the Investment Case of TSMC, which largely rests on their strong foundry market share, and the growth of the semiconductor industry fueled by IoT, 5G, automotive, and AI.

Additionally, I will briefly discuss the China vs Taiwan risk!

1. Market Share

2. Global Semiconductor Industry Growth

3. High-Performance Computing and AI

4. Competitive Advantages

5. China vs Taiwan

6. Valuation

7. Conclusion

1. Market Share

TSMC makes money by manufacturing chips according to the design and specifications of its clients. Unlike Intel, Nvidia, Qualcomm, or Samsung, TSMC doesn’t design the chips, their sole focus is manufacturing semiconductors as efficiently and cheaply as possible, while meeting the strict quality requirements of their picky clientele.

While TSMC has been the leading independent pure-play chip contract manufacturer since the early 2000s, in the 2020s, its market share has exploded.

According to the above graph from Counterpoint Research, in Q4 of 2024, TMSC had a mind-boggling 67% market share!

This is a huge increase from the approximately 52% market share it had in 2019!

Samsung Foundries is a distant second with an 11% market share, and no other foundry has more than 5% market share.

TSMC’s market share advantage is even greater when one looks at the most powerful, the most advanced, cutting-edge chips.

The company holds a 90% market share in advanced chips!

The smaller the chip, the more powerful it is, and TSMC is essentially the only manufacturer able to make 5nm, 4nm, and 3nm chips at scale.

Furthermore, TSMC is set to be the first Foundry to manufacture the most advanced 2nm chips in 2026. With rumors circulating that the iPhone 18 will be the first to use them.

This clearly indicates that TMSC is not merely maintaining its lead but actively expanding it!

A dominant foundry market share enables TSMC to demand high prices for its chips. As there is no other supplier capable of even remotely challenging TSMC, Apple and Nvidia have no choice but to open their wallets and pay the prices TSMC demands.

This enables TSMC to have unprecedented margins for an industrial company. In Q1 2024, TMSC had a gross margin of 59% and an operating margin of 49%.

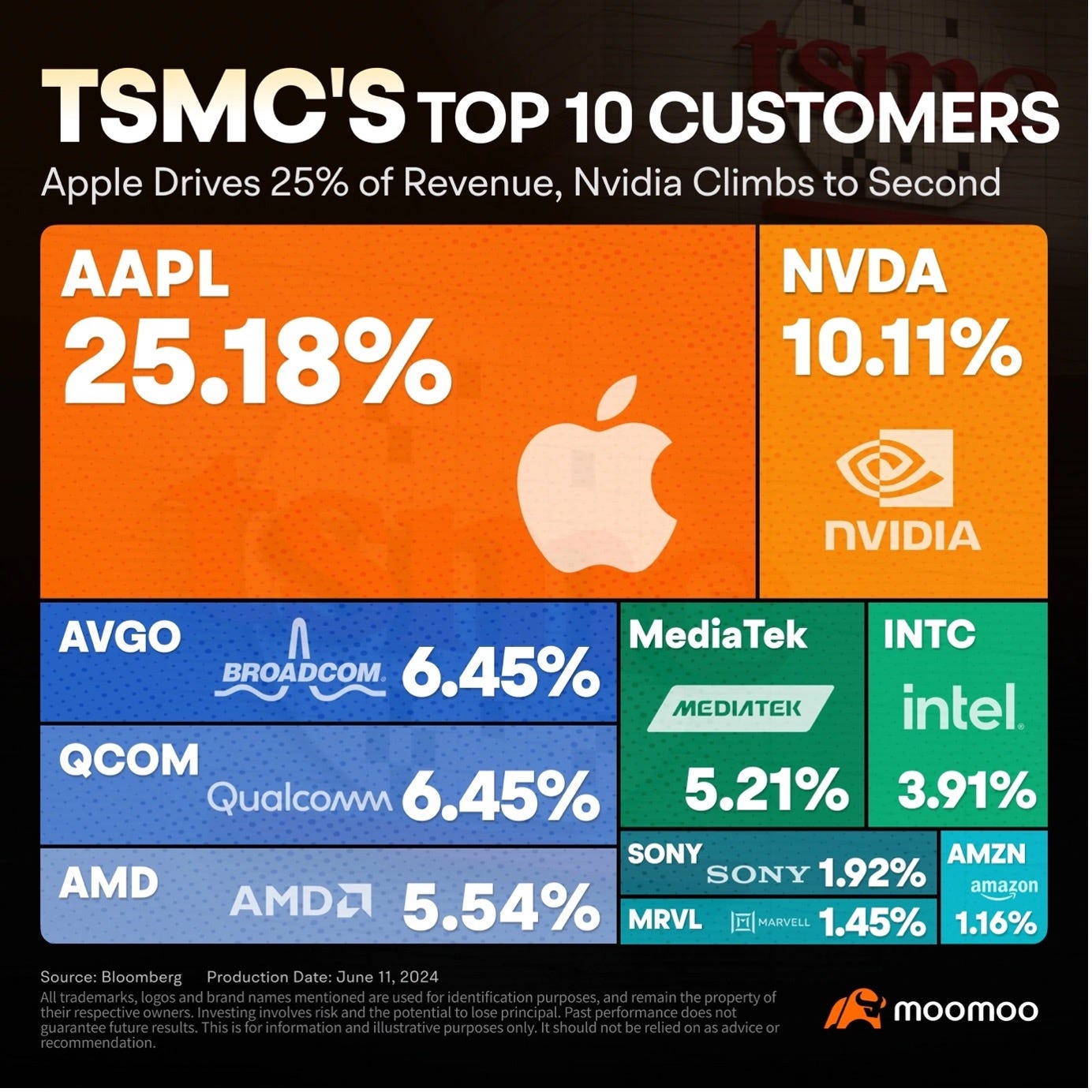

While TSMC doesn’t disclose the revenue per client, estimates from Bloomberg indicate that Apple is by far their largest client, responsible for 25% of sales.

This is a highly lucrative and sticky long-term partnership. As mentioned, TSMC makes the processors that run Apple’s newest iPhones.

Apple can’t leave, and even if they wanted to, it would take years and would be extremely costly!

Approximately 10% of their revenues come from Nvidia, as TSMC is the manufacturing muscle behind Nvidia’s high-demand, brainy AI chips.

Strong relationship with the world’s largest technology companies solidifies their moat and creates a growing and recurring revenue stream.

Apart from the risk of the Chinese invasion of Taiwan, I see no threat to their continued global dominance.

TSMC is extremely well-positioned to reap the benefits from the ever-growing global demand for semiconductors!

2. Global Semiconductor Industry Growth

In the last few years, the global semiconductor industry has experienced very strong growth, and most industry experts believe that this will continue for a long time.

As I mentioned in the introduction, everything is becoming a computer, and this trend is likely to continue.

According to Precedence Research, the total global semiconductor market is forecast to grow at a 7.5% per year to reach $1.2T by 2034!

With sales of $88B in 2024, TSMC generated 15% of the value of the total semiconductor industry.

If TSMC were to keep the same 15% value share in 2034, its sales would reach $182B, more than doubling.

However, I find it very likely that TSMC will significantly increase its value share, as the company is leading in the key areas that are set to grow the fastest.

Let’s explore them.

Automotive Industry

As electrification accelerates, cars are increasingly becoming computers on wheels. Electric vehicles are, in some sense, just larger and more complex mobile phones with a huge battery. You might think this comparison is a bit stretched, but the Chinese mobile phone company Xiaomi disagrees.

Additionally, new vehicle buyers have become quite picky, demanding improved customer experiences and reliable integrations with their devices. To satisfy these evolving customer requirements, auto manufacturers are set to become huge buyers of semiconductor chips.

A modern EV contains 2,000 to 3,000 semiconductor chips!

Market Research Future estimates the automotive semiconductor market to grow with a 10.7% CAGR to reach $128B in 2032!

In 2024, approximately 5% of TSMC’s sales came from the automotive sector.

To satisfy this growing demand, TSMC is building a new foundry in Dresden, Germany, that is scheduled to start production in 2027.

Autonomous Vehicles

In addition to electrification and improved user experiences, the looming adoption of autonomous vehicles is also driving the growth of the automotive semiconductor market.

Above, I have placed the estimates from Precedence Research for Robotaxi and the Autonomous Vehicle (AV) markets.

Robotaxi market is forecast to grow 60% per year to reach $189B by 2034, whilst the entire AV market will grow 36% per year to reach $4.5T!

Companies such as Waymo (Google), Tesla, Baidu, and Zoox (Amazon) are investing billions of dollars in building vehicles and software to develop autonomous driving.

Meanwhile, Intel, AMD, Nvidia, Qualcomm, and Mobileye are designing the chips that power the software that drives the car.

But TSMC is the one that manufactures these chips!

To develop and run robotaxis, some of the most advanced and expensive chips are crucial. Whoever designs these chips, whether that be Tesla, Nvidia, AMD, Intel, or someone else, it is increasingly likely that no one but TSMC can manufacture them.

In addition to processors inside the car, TSMC also manufactures tiny chips that are crucial for components such as radar and lidar sensors. Customers include large semiconductor designers such as Texas Instruments, NXP, and Analog Devices.

5G

TSMC makes chips that are crucial in facilitating the increased processing power requirements of advanced communications equipment.

Marvell Technology uses TSMC to manufacture networking processors for 5G base stations and network equipment. Additionally, Broadcom’s networking switches that are integral to 5G infrastructure deployment are made by TSMC.

Lastly, 5G networking equipment manufacturers and installers such as Nokia, Ericsson, and Fujitsu rely on dozens of chip suppliers, many of whom are customers of TMSC.

Straits Research forecasts that the global 5G Equipment Market will grow with a 35.85% CAGR to reach $177.27B by 2033!

Thanks to its technological advantage and strong relationship with key 5G semiconductor designers, TMSC is well-positioned to grow in this segment!

Internet of Things

Internet of Things (IoT) refers to devices that contain various sensors, networking equipment, and software that facilitate communication between the device and the internet. In the last few years, thanks to the development of fast, cheap, and reliable internet, IoT devices have grown in popularity.

Grand View Research forecasts that the global IoT device market will grow wth a 16.8% CAGR to reach close to $180B by 2030!

As the market grows, the demand for chips that facilitate the transfer, processing, and analysis of the data generated by these newly connected devices will grow immensely.

This market encompasses not only smart home solutions and interesting gadgets but also industrial automation, urban planning, and smart city solutions.

3. High-Performance Computing and AI

While the previously mentioned segments will see a significant increase in demand, the one segment that will drive the majority of TSMC’s growth is High-Performance Computing (HPC) and AI.

HPC chips power data centers that enable our modern existence. While Nvidia, AMD, and Intel are the key designers, TSMC is manufacturing chips for all of them. Without these chips, neither Amazon, Microsoft, nor Google could provide cloud infrastructure services, and without cloud infrastructure, modern cloud-based services couldn’t exist.

HPC chip sales reached $45B in 2024, 51% of TSMC's total revenue, and since 2017, sales have grown by 403%, a CAGR of 26%!

Revenue growth accelerated in 2024 to 47.5% from 0% the prior year, driven by an insatiable demand from Nvidia and its hyperscaler clients, Amazon, Google, Meta, and Microsoft.

Just these 4 companies are expected to spend around $320B on capex this year. A large share of that will go directly to Nvidia and AMD for their most advanced data center chips, which are manufactured by TSMC.

The continuous demand for cloud services and the adoption of AI across many industries is driving huge demand for TSMC services!

Mordor Intelligence believes that the global Cloud Computing Market will grow with a 16.4% CAGR to reach $1.69T!

As the world’s economies continue to digitize and move, an ever-growing amount of data to the cloud, the need to store, process, and analyze it grows every year.

As the demand for computing grows, TSMC is ready to manufacture the necessary quantity of chips to satisfy the demand of cloud infrastructure providers.

In addition to meeting the increased cloud computing processing power needs, old chips need to be replaced as well, as their life spans are around 3-5 years. This further strengthens the demand for TSMC services.

In addition to running normal cloud services, a significant share of the HPC chips will be used in training and running AI.

After ChatGPT exploded on the scene in 2022, it became unmistakably clear that AI has arrived. The release of this revolutionary product spurred many companies into action, and global AI investments exploded, leading to a surge in demand for Nvidia’s most powerful chips.

Precedence Research estimates that the AI chip market will grow with a 28.9% CAGR, reaching $927B by 2034!

AI requires vastly more processing power than the world has. Today, the majority of computing is spent on training. However, in the future, when advanced AI models are developed, constant use of these models will consume the majority of the computing.

Such intensive use puts an incredible amount of strain on AI chips, reducing their useful life to just 1-3 years. This bodes well for TSMC, which will gladly manufacture the replacement chips!

Overall, the demand for AI chips remains strong, and TSMC is well-positioned to benefit deep into the 2030s!

4. Competitive Advantages

Pure Play

TSMC is a pure-play semiconductor foundry that doesn’t design its own chips. This means that TSMC doesn’t have any conflicts of interest with its clients. Meanwhile, Samsung and Intel are trying to grow their foundry businesses, despite designing and selling their own chips as well.

Why would technology companies such as Apple, Dell, Microsoft, Nvidia, and AMD, who compete with Intel and Samsung, financially support their direct competitor? Having no conflicts of interest makes it easier for TSMC to work with the largest technology companies of today.

Scale

The principle of economies of scale dictates that the larger the company is, the lower the costs for each unit of output. In this regard, TSMC has incredible scale advantages over its competitors.

TSMC’s foundries are the largest and most sophisticated in the world, churning out billions of chips. With such a large business, TSMC can extract huge concessions and discounts from its suppliers, significantly reducing costs.

In 2024, TSMC spent $34B on capex, and Wall Street analysts estimate that around $130B will be spent in the next 3 years. No other competitor has the scale to match such investments.

Sticky Customers

TSMC’s largest customers are unlikely to leave because they are extremely profitable, large companies that have worked with TSMC for a long time.

Think about it, why would Apple pick a new foundry to make chip for the iPhone? So far, TSMC has more than delivered on its promises. Apple’s designed processors are of the highest quality, delivered reliably, without a hitch. Apple is not going to risk it to save a few dollars per iPhone.

TMSC is the only company capable of manufacturing the most advanced semiconductor chips desired by its clients. As long as that remains the case, the Apple’s and Nvidia’s of the world will remain with TSMC. Even Intel was forced to eat its pride and make some chips with TSMC.

TSMC Wins no matter who Wins

The semiconductor industry is possibly the most technologically advanced industry on earth. Today, Nvidia is on top of the world, tomorrow, AMD, Intel, or a new start-up might challenge that.

For TSMC, it doesn’t matter who is at the top, because they probably will end up making the chip anyway!

Building a Foundry costs tens of billions of dollars and takes 3-5 years. Even if a new start-up comes out with a chip that is better than Nvidia’s, there is no company apart from TSMC that can manufacture it.

5. China vs Taiwan

Let me briefly explain the history of China and Taiwan tensions.

In 1911, the 300-year-old Qing dynasty collapsed, ending the monarchy in China. After the revolution, many factions were vying for influence, which eventually exploded in a full-blown Civil War between the Communists (CCP) and the Nationalist Kuomintang in the 1920s.

The fighting paused during WW2, but after the US victory over Japan, the Chinese Civil War resumed. It largely ended in a decisive Communist victory, and the People's Republic of China was officially established on October 1, 1949.

However, the War actually never ended, as the Nationalist Kuomintang retreated to the island of Taiwan.

To this day, both parties claim to be the true legitimate China, and claim dominion over all of China.

However, while it lacks international diplomatic recognition, Taiwan is a de facto independent country, with democratic elections, currency, a passport, and a military. Additionally, it has a strong and technologically advanced economy.

The official position of the CCP is that Taiwan is a rogue Chinese province and will be reunited with China, either willingly or through War.

The Taiwanese people don’t want to be part of China, and opinion polls show that they increasingly view themselves as Taiwanese, rather than Chinese, despite being ethnically Han Chinese.

Both China and Taiwan are preparing for War, and many military experts believe that a War is inevitable!

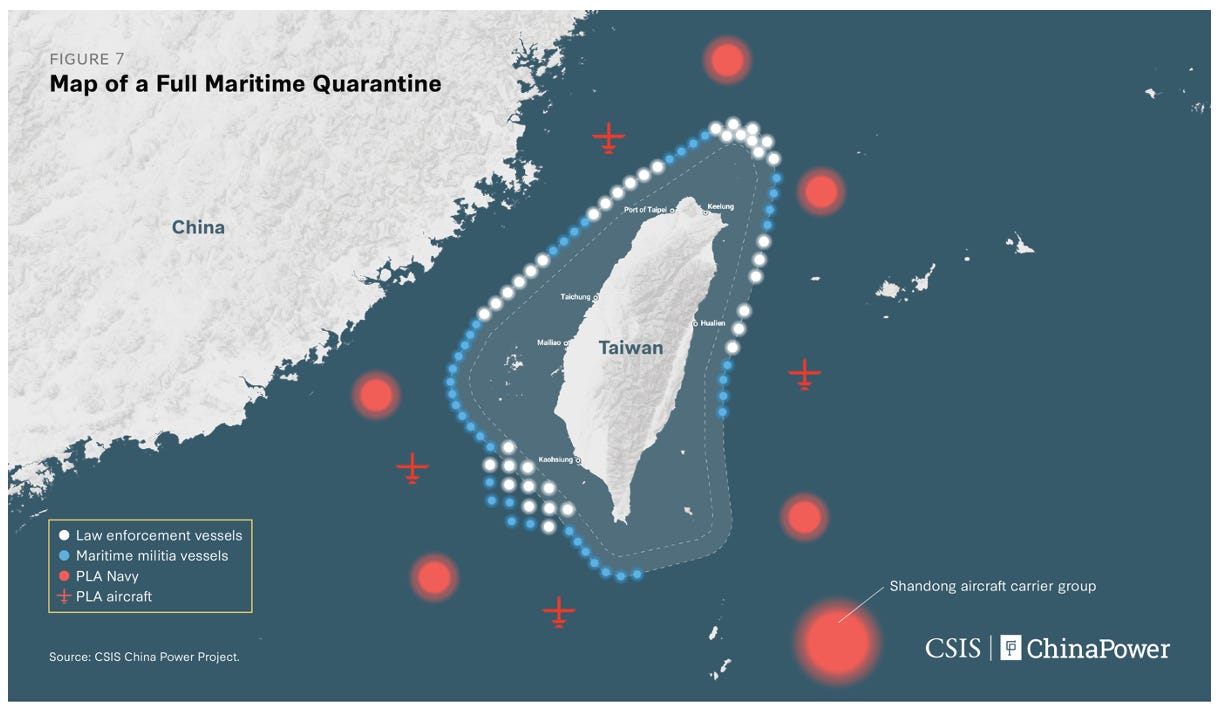

In the picture above, we can see that because of a difficult geography, Taiwan has incredible defensive advantages, so millions of invading soldiers would die. However, because of the sheer size of Communist China and the determination of the CCP, the eventual loss of Taiwanese independence seems increasingly likely.

Most dangerously, there is a risk of the War escalating and spreading, as the US, Australia, Japan, South Korea, North Korea, and the Philippines have, in various instances, signaled that they would not do nothing if China invades.

In case of a Chinese invasion of Taiwan, TSMC is essentially a zero!

Most of TSMC’s assets and people are in Taiwan, and rebuilding abroad would be difficult and extremely time-consuming, and create serious issues.

This largely explains the current valuation of TSMC.

Without this risk, a company with such high-quality business and a strong growth outlook would be trading at a $2-3T market cap, instead of a $700B.

However, I believe this presents an opportunity for patient, long-term-minded investors with a higher appetite for risk!

6. Valuation

With a market cap of $700B, TSMC currently trades for a P/E of just 18.

This is an extremely cheap valuation for a company with such high profitability and a growing TAM!

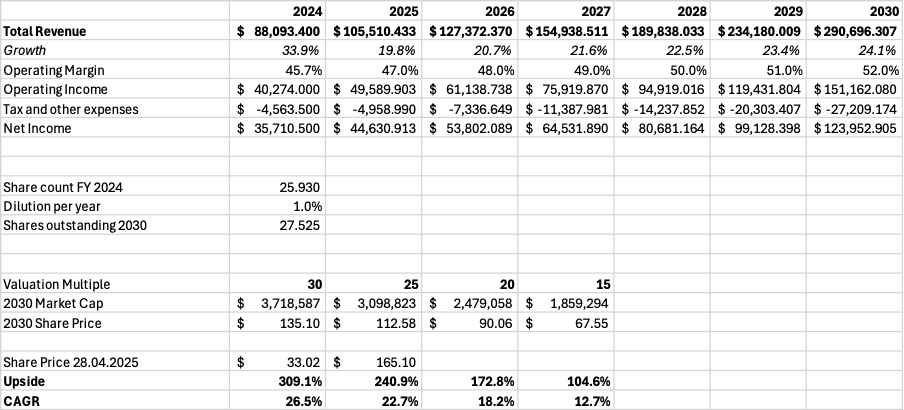

In the table above, I have placed some key valuation metrics.

Wall Street analysts expect that TSMC will grow sales by 28.6% in 2025 and 77% over the next 3 years!

Strong pricing power and high demand for its products will propel TSMC's margins even higher. EBIT are EPS are set to grow by over 82% in the next 3 years.

Moreover, while in 2025, FCF growth will be lower due to elevated Capex, over the next 3 years, FCF is set to increase by over 112%.

Taking growth into account, the 2027 P/E is 11 and P/FCF is 13!

I built a valuation model to see what kind of returns TSMC investors could expect.

Valuation Model

Thanks to strong AI, data center, cloud, and 5G chip demand, TSMC’s largest segment is poised for strong growth.

I model the High-Performance Computing segment to grow with a 30% CAGR to reach $217B in 2030!

Depending on estimates, the global smartphone market is projected to grow with around 7.5% CAGR till 2030. I model TMSC’s smartphone revenues to grow at the same pace to reach $47B.

As mentioned, the IoT device market will grow with a 16.8% CAGR, so I find it likely that TSMC can grow with at least a 15% CAGR, to reach around $11.7B.

The automotive chip market is projected to grow with an 11% CAGR. Taking into account TSMC’s position in advanced chips and existing relationships with strong automotive chip designers, I find it likely that TSMC will grow faster and capture a larger market share. A 15% CAGR would result in sales of $9.8B.

Overall, I model total revenues growing by 230%, a 22% CAGR, to reach $290.7B in 2030!

Additionally, I model the operating margin improving from 45.7% to 52%.

This would lead to operating income reaching $151.2B, an increase of 275%!

In this scenario, net income could reach $124B!

A 1% dilution seems reasonable for such a low dilution company.

Another caveat is that TSMC trades in the US under the ticker symbol $TSM for $165.10 per share, but this is equivalent to 5 shares of TSMC’s Taiwan stock market listing. So that is $33.02 per share in Taiwan-listed stock equivalents.

If TSMC still trades at a distressed multiple of between 15-20, I see a 104.6% to 172.8% upside for TSMC by 2030!

However, if tensions between China/Taiwan/USA ease, TSMC could trade for a multiple that is more fitting for a company of their stature.

A P/E of 25-30 would result in an upside of 240.9% to 309.1%!

7. Conclusion

While it is undeniable that TSMC is one of the most important technology companies of today, it is within the realm of possibility that the stock goes to zero!

Communist China is doing everything that a country preparing for War would do!

They are undergoing the biggest military buildout in modern history, focusing on exactly the weapons that would be needed to conduct a sea invasion. Additionally, the country is stockpiling important commodities such as oil, grains, and metals. At the same time, they are building infrastructure in Myanmar, Pakistan, Kazakhstan, Laos, Russia, and other countries to facilitate alternative trade routes that the US can’t disrupt.

Personally, I find it highly likely that China will invade Taiwan. While the economic and humanitarian consequences would likely be severe, this is not a question of economics, but of national and communist pride.

CCP is determined to finish the Civil War and bring Taiwan back into the fold.

Trump’s Trade War and alienation of all US allies make it more likely that China will invade, as in China’s eyes, Trump is making Taiwan weaker.

However, there is a valuation at which the risk and reward ratios become highly attractive!

At 18 P/E, TSMC is dirt cheap for a company with such strong growth prospects.

It is a perfect investment for someone with a higher risk appetite than me. I have added TSMC to my watchlist and plan to reassess the situation if the stock falls further, growth increases, or the risk of invasion decreases.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

I linked to your post in my Monday links roundup: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-may-12-2025

Also note that China can only invade Taiwan during certain weather windows, there would be at least a 12-18 hour warning (unless it happens during a "blockade exercise") as the ships have to cross the straits, nobody knows how much of a fight the average Taiwanese might actually put up (so there is the risk of miscalculation) - much of the elite probably have foreign citizenships, etc etc - lots of unknowns.... However, I've been to Kinmen (impossible to defend) + Matsu Islands/Penghu (also potentially hard to defend) - China could try grabbing those along with Turtle and Green Islands...