10 AI Stocks for 2026!

The year AI applications begin its rise.

Welcome to Global Equity Briefing, my twice-weekly investing newsletter.

I am Ray, a passionate investor and equity analyst. Today, I am presenting my top 10 AI picks for 2026.

2025 has been an absolutely rollercoaster year for AI stocks.

By October 1, Iren had risen an incredible 368%, whilst Nebius jumped 298%. WhiteFiber had a blockbuster IPO, flying up 122% in just 2 months.

Nvidia rose by 60%, briefly reaching a $5T market cap.

Oracle jumped 97% on the back of a blockbuster $300B cloud agreement with OpenAI.

But in the last 2 months, the market has lost interest in AI names, with Iren, Nebius, CoreWeave, and Oracle all falling over 40%.

In my opinion, this can be largely explained by the following reasons:

1. OpenAI has strategically signed partnership agreements with essentially all AI ecosystem companies. OpenAI is desperate for capital and compute, resorting to ever more creative agreements. Even Disney is investing $1B in OpenAI, which OpenAI will just pay back to Disney to license its characters for AI photo and video generation. These circular deals with OpenAI are driving worries of a bubble.

2. CoreWeave announced construction delays. The company blamed bad weather, slower execution by the colocation vendor, and supply chain issues. This raised fears with analysts that the whole AI sector is exposed to serious delays.

3. Investors are getting more worried about funding. Despite expectations for interest rates to be reduced, the cost of capital might rise if available capital decreases. Just yesterday, Blue Owl dropped out of funding Oracle’s $10B data center in Michigan, because, reportedly, they demanded better terms. This crashed all AI stocks yesterday.

4. Energy bottlenecks. In a recent interview, Jensen Huang said that the US is losing the AI energy race to China. While China is generations behind the US in chips, it might not matter if it has more energy capacity.

5. Google rose like a “phoenix from the ashes” to reconquer the AI crown. While this was certainly appreciated by Google’s shareholders, as the stock has risen 70% in 2 months, it has negatively affected other stocks. If OpenAI loses the consumer chatbot race to Gemini, then it won’t have the capital to fund all those infrastructure contracts with Nvidia, AMD, Broadcom, and Oracle.

While these are serious concerns, they do not impact all AI players.

My thesis is that, as 2024 and 2025 were largely dominated by AI infrastructure, 2026 will be the year in which companies that apply AI to generate real value will get appreciation from Mr. Market.

For this reason, I have decided to release a list of 10 AI stocks for 2026.

However, I also see 3 AI infrastructure stocks doing quite well.

Let’s take a look.

1. Iren

Market Cap: $10B

P/S: 14

IREN is an Australian technology company that develops and operates bitcoin mining and AI data centers, primarily focused on serving Hyperscalers.

The stock has fallen 56% from its all-time high on November 5. The company’s performance has been driven by fears regarding its ability to fund its ambitious data center roadmap.

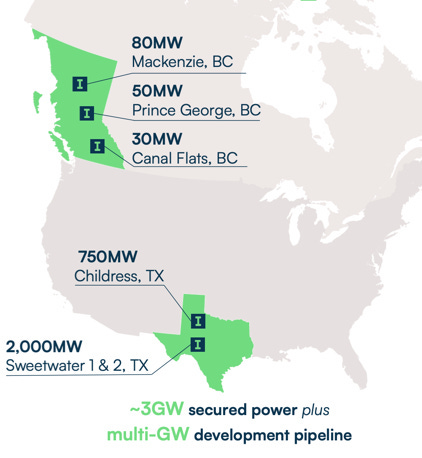

Iren is currently developing 6 data centers in Texas and British Columbia with an estimated capacity of 3GW. A few months ago, the company signed a 5-year $9.7B, ($1.94B per year) deal with Microsoft for 200MW of that capacity. Originally, investors did back-of-the-napkin math and concluded that this deal implies that 3GW could have a revenue potential of $29B per year, and the stock soared.

However, now investors are doing the math and realising that it would be incredibly expensive to bring this whole capacity online as a bare metal data center. Iren said that building the 200MW data center and equipping it with GPUs will cost around $8.8B.

That would imply that to turn all 3GW into bare metal AI data centers could cost $132B!

Mr. Market is now questioning where Iren will get that kind of funding.

And recently, the company answered that question by issuing $2.3B of convertible notes worth 44.7M shares, presenting a potential dilution of 13.5%, depending on the final conversion price and net result of a capped call dilution hedge they did.

In my view, Iren could do well in 2026, and the current set-up looks interesting to me because of the following reasons:

1. Dilution fears are overblown – Yes, Iren will issue a lot of new shares in the future, but not 3-5x more, as some have speculated. Investors are forgetting that Iren is still unproven in the eyes of bankers and credit investors. But once the first Microsoft data center is built, they can raise cheaper asset-backed mortgage funding.

2. Cheap energy sources – Iren has strategically located its data centers in areas of low energy cost, making it cheaper to operate. Thus, the company can get better terms from clients than others.

3. Energy access – On top of the energy price, the mere fact that they even have energy access is a huge advantage. It is quite likely that the company will get even better pricing from customers in the future as the lack of energy drives AI customers to bid more aggressively for available capacity.

4. Efficient data centers – Iren Bitcoin data centers are the most efficient in the industry, signaling that similar feats are doable for AI data centers. This is yet another factor increasing their ability to get favorable contract terms from clients.

5. Pre-pay – Microsoft agreed to pay for 1 year in advance now, and whenever GPUs come online. This is essentially an interest-free loan that reduces Iren’s cost of capital.

6. Vendor financing – Additionally, Dell is providing 24-month equipment vendor financing, starting with $199M. This means that Iren will need even less upfront capital to start, as the company can time equipment payments with incoming cash flow from contracts.

7. Colocation opportunity – GPUs are the most expensive parts of a data center. If Iren can’t raise capital, they can give up data center space for colocation, bringing in stable rental income. This generates less revenue per capacity, but is still profitable, whilst requiring 50-70% less capital.

In 2026, Iren will bring the Microsoft data center online and begin servicing the contract, showing real revenues in the income statement. Furthermore, new hyperscaler contracts could be signed for the remaining capacity, further benefiting the stock.

Read more in my Iren Investment Case! (Free)

2. Nebius

Market Cap: $19B

P/S: 71

Nebius is an AI infrastructure and cloud computing company based in Amsterdam, Netherlands, that provides high-performance computing and AI cloud services.

The stock has fallen 44% from its all-time high on October 13. The company’s performance has been driven by the same funding fears affecting Iren.

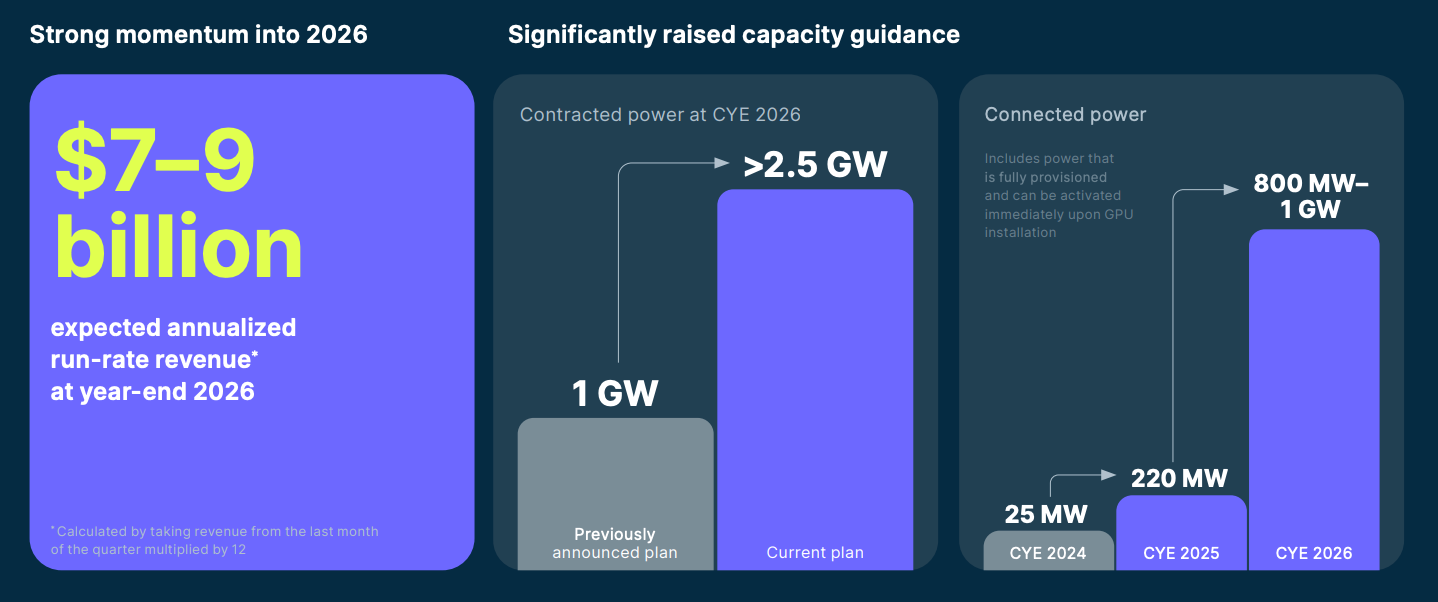

After presenting Q3 2025 earnings, Nebius announced ambitious new plans. Increasing their contracted power target to 2.5GW and connected power target to 0.8-1GW. This would directly translate into higher revenues, thus the company increased the 2026 ARR target to $7-9B.

This means that Nebius trades 2-3X its 2026 ARR.

To bring this capacity online, Nebius increased its 2025 capex guidance from $2B to $5B.

Similar to Iren, Nebius has resorted to issuing convertible notes and selling equity to raise capital.

In my view, Nebius could do well in 2026, and the current set-up looks interesting to me because of the following reasons:

1. Valuation – Simply put, 2-3X forward ARR is quite an attractive valuation for such a fast-growing, promising company. For now, their ARR guidance has been seen as “theoretical wishful thinking”. In 2026, it comes to life.

2. ClickHouse – Nebius owns 28% of this data analytics and labeling company, valued at $6.4B during the last funding round. Anthropic uses them to train their AI models. Its ARR has grown over 4x in the past year, and the company is preparing for an IPO. Nebius’ stake could be worth $3-5B depending on the IPO valuation, and up to $8B in a few years. Presenting Nebius with an opportunity to sell their stake to raise capital for the core AI business.

3. Avride – Recently, this Nebius autonomous driving start-up began robotaxi operations in Dallas through a partnership with Uber. This makes this company highly valuable, and is a testament to Nebius AI cloud, which is instrumental for training and running Avride’s AI. This stake could be worth many billions of dollars.

4. Dilution fears are overblown – Similarly, as Iren, dilution fears are overblown as investors are forgetting that, as more mature companies, both Iren and Nebius will be able to use less expensive bank financing. But Nebius additionally, will additionally raise billions from selling stakes in ClickHouse and Avride.

5. Colocation strategy – Nebius is partnering with colocation companies to operate data centers. This means that Nebius is exchanging capex for opex. Instead of paying huge upfront expenses to build a data center, the company is renting space in already built data centers and bringing its own GPUs. This means that Nebius will need significantly less capital to scale than Iren. However, that also leads to higher operating expenses, as Nebius must cover the colocation provider’s margin. That’s the trade-off.

6. AI Cloud strategy – Nebius is not just a bare metal, they are a fully-fledged AI cloud. The company has been routinely grouped together with publicly traded bare metal and colocation companies. Recently, even Bloomberg included them in an article about Bitcoin miners turned AI data center operators, despite them never having anything to do with Bitcoin. I think in 2026, as the ARR explodes and Nebius grows its list of AI cloud partnerships with the best AI startups, that narrative will be put to rest. Even recently, there were media reports of a leaked AWS internal memo stating that the company is losing AI start-up cloud business to Nebius.

Read more in my Nebius Investment Case! (Free)

3. ASML

Market Cap: $391B

P/E: 36

ASML is a global semiconductor equipment company based in Veldhoven, Netherlands, that designs and manufactures advanced lithography machines used by chipmakers to produce the most advanced chips.

The company holds a monopoly on extreme ultraviolet (EUV) lithography machines. These super-advanced bus-sized pieces of critical technology are used by chipmakers like TSMC, Intel, and Samsung to manufacture the most powerful chips.

Without ASML, modern smartphones, data centers, AI models, and even military systems would simply not exist!

Each EUV machine costs over $200 million and takes months to build, yet ASML can’t keep up with demand. Their technological lead is measured not in years, but in decades.

This near-total dominance allows ASML to exercise extreme pricing power, generating $11B in high-margin profits annually, with zero competition on the horizon.

Their newest High-NA EUV machine costs $400M, is even more complicated, and is designed to mass-produce AI chips.

As the world becomes more reliant on cloud and AI computing, the demand for ASML’s machines is only set to grow, making it one of the most irreplaceable companies on Earth.

Yesterday, there were some reports that China has an EUV prototype, sending the stock down close to 6%.

A reminder that due to export restrictions, the most advanced ASML machines can’t be sold to China. My opinion is that this is nonsense propaganda made by China to exert pressure on the Dutch, so they pressure Trump to allow ASML machine sales to China.

In my view, demand for ASML’s machines will be higher than most expect. This is because, as energy becomes a huge bottleneck for AI, the need for more efficient data centers will become increasingly apparent.

By some estimates, their newest High-NA EUV machine’s 1.5nm chips could have 20-30% better performance at the same power, or require 40-50% less power for the same performance.

2026 will be the year that the market realizes this and ASML’s backlog growth exceeds expectations.

4. Google

Market Cap: $3.6T

P/E: 30

In April of 2025, Google had a market cap of $1.8T and was trading for a P/E of 17. Since then, the stock has risen 103% as it continues to prove skeptics wrong.

Whilst many investors believed Google’s glory days were behind it, the company is proving otherwise.

AI will transform search and grow the overall internet search pie to levels previously unimaginable. While Google will likely technically lose market share, as ChatGPT and others grow, it will be slowly, and Google won’t see a rapid erosion of profitability. Rather, search profits will continue to grow. While at a slower pace than historically, it will still be a healthy 9-13% rate per year.

What Google search doomers are forgetting is that the company generates close to $100B in EBIT from search, which it reinvests in high-return ventures.

The search business was 100% of the company 20 years ago, but today it is just 56%. Google has demonstrated its ability to invest in new and highly profitable ventures, such as YouTube, Cloud, Android, and soon to be Waymo.

In the 1990s, Windows was 100% of Microsoft’s business, today, it is just 9.5%. This transition happened not because Windows revenues fell as new operating systems emerged, but because Microsoft took its monopolistic Windows profits and invested them in new businesses.

Search will be to Google what Windows was to Microsoft!

In the last few months, they have significantly improved their AI to such an extent that OpenAI was forced to declare “Code Red”. The media is reporting that OpenAI is shelving various monetization efforts to focus on improving core AI to better compete with Gemini.

A key factor in Google’s recent success is its custom-designed TPU chips, which have proven cost-effective at certain AI workloads. This is an advantage that no other AI applications company has.

Google can train and operate AI models cheaper than OpenAI, Perplexity, and others.

And it can deploy AI across its vast ecosystem quickly and on a massive scale. It doesn’t have to search for deployment partners like OpenAI and others.

In 2026, Google’s rise will continue as the market realizes its strong position in AI infrastructure, and its best ecosystem for AI application deployment gives it an unprecedented advantage.

My prediction is that Google will become the largest company in the world in 2026!

5. Zeta

Market Cap: $4.3B

P/S: 4

Zeta is a marketing and advertising technology company that uses AI to help brands identify potential customers to then acquire, retain, and engage them.

Here is how it works:

Zeta’s clients carefully explain their business model and upload their customer records to Zeta’s marketing platform. Zeta uses AI to analyze this data and all other data it has from running millions of campaigns for thousands of companies for 250M+ people in the US.

The AI then recommends what steps to take to meet a client’s goal.

If the goal is to reduce customer churn, the AI suggests activities to retain customers, such as promotions, discounts, and loyalty plans. If it’s customer acquisition, it creates, runs, and optimizes advertisement campaigns.

To achieve these goals, the company enables omnichannel customer activation over email, SMS, apps, TVs, web, and social media. Additionally, Zeta provides an extensive set of software tools for analytics, SEO, generative engine optimization, AI automations, AI Agents, and more.

For more, read my Zeta Investment Case!

This is exactly the type of AI services that I believe will be crucial in the future for companies to become more competitive. Those who don’t apply AI marketing and advertising tools will lose out to those who do.

My thesis is that 2026 will be a very good year for Zeta’s stock because:

1. The stock is still down 30% from February. This is because of a BS short seller report and a weak consumer. Its clients are primarily B2C consumer companies, such as insurance and automotive. So, investors fear that they will cut back on spending. 2026 will show that Zeta’s growth is not about consumer spending but about the adoption of its AI tools.

2. AI adoption increases. Companies are under significant pressure from shareholders to show real results from AI tools after a heavy investment phase. Higher return on advertising spending is a great way to show that, and Zeta delivers exactly that.

3. Athena AI and AI Agents. Athena is Zeta’s conversational AI chatbot for marketing teams. The demos look incredible and remind me of Palantir AIP. It’s essentially an internal ChatGPT-like tool for marketing teams, promising to drastically improve marketing employee productivity. Whilst Zeta’s AI Agents promise to automate employee tasks. I see in 2026 these tools getting a lot of adoption and being a strong catalyst for the stock.

4. GAAP Profitability. Zeta is expected to become GAAP net income profitable in 2026, and this would drive significant interest in the stock.

I like the set-up.

6. Meta

Market Cap: $1.6T

P/E: 29

Meta holds a near-monopoly on social media, through its family of apps, Facebook, Instagram, WhatsApp, and Messenger, each dominating its category with limited meaningful competitors at scale.

Meta is at the heart of the global social media ecosystem, enabling daily digital connection for 3.54B people!

Without Meta, much of our online communication, personal identity, and even small business advertising would be so different today. Its control over the attention of billions gives it unmatched leverage in digital advertising, allowing it to generate over $184B in ad revenue alone.

Meta’s position is so dominant that even government regulations and rising competition from TikTok have failed to seriously erode its user base or revenue power. Whenever a new threat comes, the company adapts and comes out stronger.

Read my Meta Investment Case for a full analysis of the company.

The stock is up only 11% YTD and is down 18% from its August highs. The market fears that the company might be overspending on AI, and experts question the ROI of this investment.

It was recently reported that Zuckerberg is planning deep cuts in its Metaverse division to fund the AI buildout. A reminder that the company is set to burn $20B on this division in 2025, a 30% cut would enable Meta to save $6B, this alone would boost operating income by 7%.

Next, bears who question Meta’s AI monetization don’t understand that Meta is already one of the most profitable AI companies in the world.

Meta is using AI to improve content recommendations and ad targeting systems. The issue is that their AI profits are hidden in the operating performance of the whole company, as they don’t have a separate AI product that would provide analysts with a simple “AI revenue” line to analyze. However, Meta is achieving real ROI on its AI investments.

Lastly, AI is making it easier to create, edit, and optimize social media content. This means more content and more time spent, directly leading to better financial results.

2026 will demonstrate that bear cases are wrong, and the stock will rally.

7. AppLovin

Market Cap: $222B

P/E: 79

AppLovin is an advertising technology company that runs ad-demand and ad-supply side platforms, focusing on mobile gaming companies. Their edge lies in increasing return on advertising spending using AI.

2025 was a transformational year that saw its stock rise by over 100% as the company sold its video game-making division to focus solely on AI advertising software. Additionally, they are taking steps to expand beyond in core vertical of app-based video game advertising into e-commerce and general-purpose advertising across connected TVs and the web. Read my Investment Case for more. (Free)

2026 will be another strong year, in which the company solidifies its app-based advertising leadership.

Previously, businesses could only use AppLovin services through sales teams that negotiated different financial terms based on various factors. In 2026, the company is releasing a self-service platform where anyone can use their AI advertising services on clear terms. This will simplify the user experience and increase the TAM by making the platform available to smaller businesses.

Next, the company is expanding aggressively in the e-commerce vertical and is seeing strong results.

Historically, video game ads largely showed ads for other video games. This is a poor user experience and has low conversions. A person playing simply wants the ad to end and is rarely interested in trying another game. At the same time, game developers limited ad inventory as they don’t want to advertise their competitors. E-commerce advertising will improve users’ experience by showing different types of ads, increase advertising conversions as people are more likely to click on a product ad than a game ad, and increase inventory as game developers are glad to advertise another product category.

This is a win-win-win strategy.

Analysts expect $7.8B in revenues for 2026 and EBITDA of $6.4B. I think AppLovin can do over $8B and closer to $7B in EBITDA. Yes, you read that right, AppLovin EBITDA margin is over 80%, and no, this is not “Adjusted.

8. Global Matrix Group

Market Cap: $126M

P/S: 0.6, FWD P/E 15

Global Matrix Group is a Las Vegas-based B2B gambling technology company and an emerging markets B2C online casino operator.

I know this is an odd pick, but hear me out.

My thesis is that AI personalization tools will help gaming companies increase customer retention and drive higher betting volumes. AI will analyse gamer betting patterns to identify what they like and suggest games or bets.

If a person is a Real Madrid fan, they will be recommended a parlay for the next 3-4 Real Madrid games. Whilst sportsbooks have been doing that for years, it has been very rudimentary. AI will make them more interesting by adding a bet on the number of yellow cards, whether Mbappe scores, the number of corners, etc.

Whilst if someone prefers slot machines, AI will look for new games and recommend them. Nowadays, there are thousands of casino games creating choice fatigue, and AI could help a customer find a game that they might like.

This will speed up gamer decision-making and help create a more engaging experience.

Simply put, gamblers will spend more time on the platforms and lose more money, resulting in higher profits for the platform.

Golden Matrix will benefit in two ways.

Their B2B platform provides online casinos with tools to operate, such as CRM, marketing, sportsbook integration, casino game integration, and customer reengagement tools. It is actively offering and developing AI casino management tools that it provides on a SaaS basis to online casino operators.

Meanwhile, their B2C platform brands Meridian Bet run online casinos in Southern Europe, Africa, and Brazil, and the Mexplay brand is active in Mexico. In this segment, the company will use the tools it has developed internally to drive higher earnings. Read my Investment Case to learn more about the company.

My thesis is that the stock will have an incredible 2026, here is why:

1. AI tools deliver real results – So far, they have said that the AI engine has driven a 3% improvement in direct engagement with recommended games, 9% increase in engagement for games a player never played before, and a 12% decrease in engagement in unrecommended games.

These results might appear deceptively small, but a 3% improvement in engagement for billions of betting wagers directly translates to millions of dollars in additional revenues. A 9% increase in new games and a 12% decrease in unrecommended games is also significant. Gamblers often get bored and quit. Moving them to a new game reduces churn and improves customer lifetime value.

Recently, Oracle validated its AI tech by including the company in the Oracle Global Reference Page, a showcase of top enterprise projects using Oracle tools.

This is a clear sign that their tech is real, as Oracle would only highlight reputable companies that deliver real results.

2. Very cheap valuation – The company trades for a P/S of 0.6 and a 2026 P/E of 15, giving investors an attractive entry point.

3. End of M&A integration – The company today is unprofitable largely because of M&A integration costs. Last year, it merged with Meridian Bet to transform into what it is today. As the CEO recently confirmed, in 2026, these integration and reorganization costs will be over, and the company will return to profitability.

4. Dilution overhang is done – As part of the acquisition, Meridian Bet shareholders got around $19M in debt, $18M of which was converted into equity in 2025. There is only $1M of the acquisition debt left.

5. 2026 FIFA WORLD CUP – This is one of the largest reasons. It will be held in the US, Mexico, and Canada, and I have no doubt that it will drive record betting volumes. That forward P/E of 15 could very realistically be much, much lower. Analysts estimate only 14% growth in 2026, but I think it will go much higher.

The setup looks very interesting.

9. Root

Market Cap: $1.2B

P/E: 23

Root is an AI-driven vehicle insurance company.

The company uses AI and first-party data collected from its customers to more accurately price risk, leading to better underwriting. It has an industry-leading gross loss ratio of 59%. Read my Investment Case to learn more.

The stock is flat YTD and down 57% from March highs. This is largely because of:

1. Tariffs are causing car repair costs inflation – Most of the parts used in vehicle repairs are imported outside of the US. Import tariffs are directly leading to higher repair costs, which could affect loss ratios for vehicle insurance companies.

2. Weak new vehicle sales – New vehicle sales are weak in 2025, with Cox Automotive forecasting 16.3M vehicles sold, around 2% higher than 16M in 2024. This is important because drivers are more likely to change insurance when buying a new vehicle.

3. Reliance on Carvana – Root has a major partnership with Carvana, with them being the exclusive insurance option on Carvana’s vehicle sale platform in states in which Carvana is active. This has driven strong growth historically, but analysts are worried that this signals a shared fate of sorts, if Carvana does poorly, so will Root. However, Root is aggresivly growing other channel partners, and recently partnered with Hyundai to sell insurance at the point of sale in dealerships.

4. Weak analyst growth expectations – Analysts expect the company to grow revenues by a modest 6% in 2026. I expect the company to overdeliver.

Overall, this works well with my AI application thesis in 2026. Root is set to use AI to reduce administrative burden, improve the S&GA, and loss ratios. Analyst expectations of higher loss ratios due to inflation ignore Root’s ability to mitigate costs.

Furthermore, I expect the company to deliver much stronger top-line results, driven by their partnership channel.

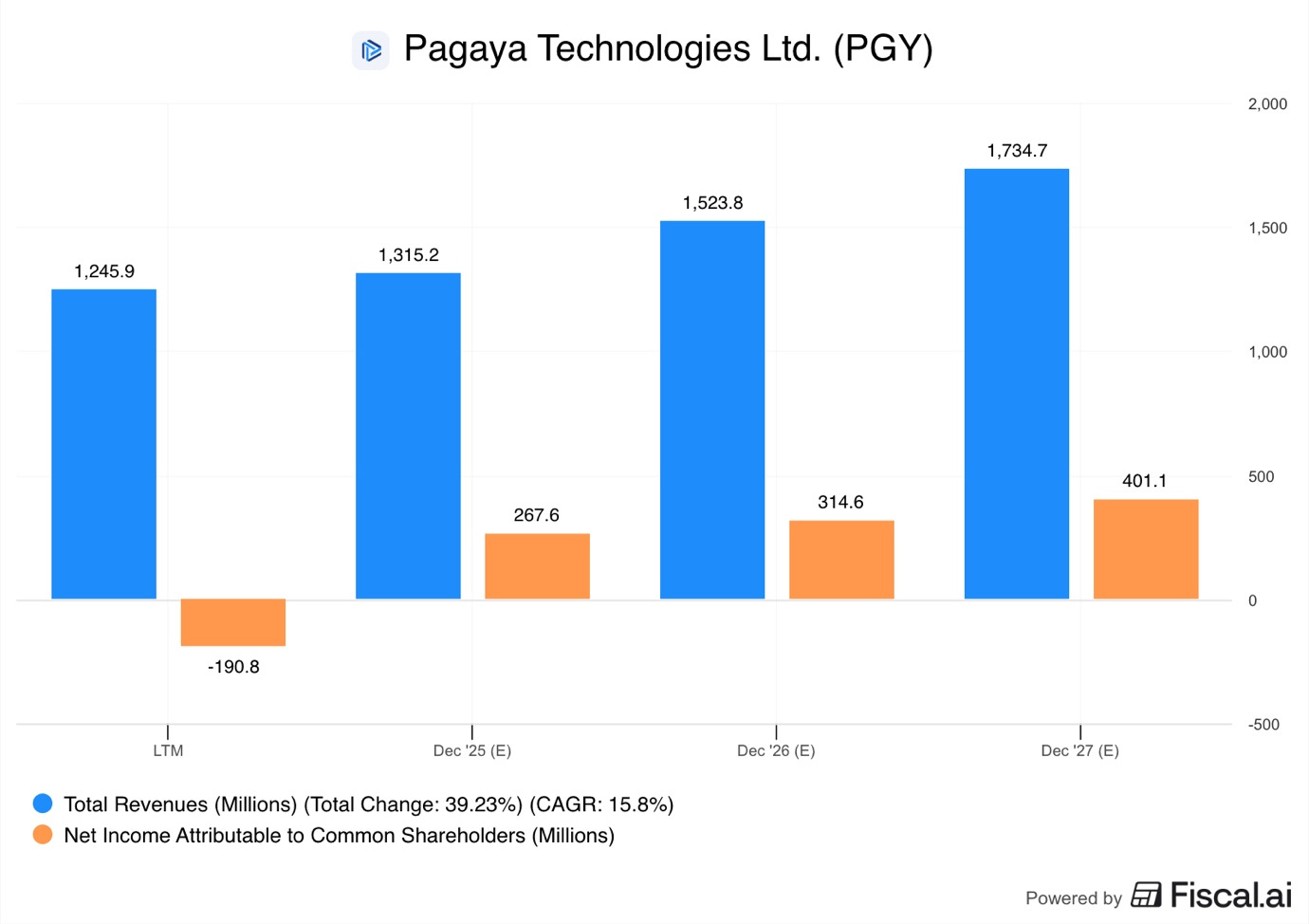

10. Pagaya

Market Cap: $1.8B

P/S: 1.5, FWD P/E: 7

Pagaya operates a two-sided credit origination platform with AI at its core.

On one side, it provides AI-driven loan creditworthiness assessment services to 31 US banks and fintechs.

On the other side, it helps 154 institutional credit investors deploy capital using Pagaya’s AI credit platform through the aforementioned 31 lending partners. Read my Investment Case for more.

Since its founding, Pagaya has evaluated $3.2T in applications, deploying $38B in credit investors’ capital.

The stock is down almost 50% since its September high, largely because of:

1. Worries regarding the health of the consumer – Papaya’s main lending partners are consumer-focused financial institutions. Thus, analysts fear that if the health of the US consumer deteriorates, loan volumes would decrease and defaults could skyrocket.

2. Strain in the private credit market – On the funding side, the company has raised $11B from credit investment funds to deploy for loans. The same investors are now actively funding AI data center buildout. If the interest from private credit investors for consumer loans decreases, Pagaya’s funding could be affected.

3. Impairments on loans on the balance sheet – Pagaya has undergone a business model transition from a loan funder to a loan facilitator. If before it took a large credit risk, now the company funded only 3.4% of the loan volumes of its platform in 2025. In Q4 2024, Pagaya did a $144M impairment of the loan fair values it held on its balance sheet.

4. Slower network volume growth – In 2025, the company has guided for only 10% network volume growth.

However, I think investor pessimism is larger than it should be. First of all, while the US consumer is under strain, the company is onboarding new lender partners constantly. If, due to consumer health, the average volume per partner decreases, new lenders will compensate.

Next, as I said already, the company funded only 3.4% of network volumes YTD in 2025, and it holds only $888M in loans on its balance sheet. Barring a major recession, fair value impairments will be minimal in the future.

Moreover, the company has guided for a 20% network volume growth across the cycle, so while network volumes grow only slightly above 10%, the company expects them to accelerate once the credit environment improves. Lower interest rates could help.

Lastly, Pagaya has demonstrated that its AI underwriting models work and are getting a strong ROI for its credit investors, otherwise, they wouldn’t be returning with more capital.

The company is trading for a 2026 P/E of 7.

I think 2026 is the year in which the attention of the market will shift to those AI companies that are getting real and measurable earnings. Pagaya is well-positioned to be a significant winner in 2026.

Here is what my Premium Members can expect:

Portfolio Review - Each month, I will present the portfolio performance and discuss my stock watchlist and my best ideas.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Strong take on the AI application layer thesis. The Zeta pick is paritcularly compelling because marketing ROI is one of the few AI usecases with immediate measureable impact. I've seen similiar dynamics at enterprise saas companies where adoption accelerates once CFOs demand tangible returns on AI spend. The 2026 GAAP profitability milestone combined with Athena AI rolout could be a serious cataylst.

Really good write up. Thanks Ray!