AST Space Mobile Investment Case!

Revolutionising Satellite Communication!

Welcome to Global Equity Briefing, my twice-weekly investing newsletter.

I am Ray, a passionate investor and equity analyst. Today, I am analyzing a type of company in which equity investors rarely have a chance of investing.

Venture capital (VC) funds invest in companies whose founders have a great business idea but lack the capital to bring it to fruition. While VC investing has been made world famous by the successes such as Uber, Google, Airbnb, and Spotify, the truth is that the vast majority of VC-backed companies fail.

This is because not every idea that sounds good in theory can become a viable business, making VC investing quite risky. Despite that, many still do it because one huge winner can more than compensate for all the losers.

Well, today I am covering a publicly listed VC-like, high-risk, high-reward investment opportunity that could become that big winner all VC investors dream about.

AST Space Mobile is a satellite technology company aiming to transform global communications by eliminating connectivity gaps. They are building the first and only space-based cellular broadband network designed to connect directly with standard, unmodified smartphones.

Recently, the company has been signing new partners after another, driving significant optimism, which has enabled the stock to jump 302% YTD, reaching a market cap of $30.7B.

This is despite the company having sales of just $18.5M, giving a P/S multiple of 1,659.

This lofty valuation can be explained by the company’s highly ambitious goal of becoming a leading direct-to-device satellite communications company for hundreds of millions of potential customers.

The company is exiting the technology validation stage and moving on to the commercialization!

Its next-generation BlueBird satellites are scheduled to launch from India in just a week on 20 December.

Bulls argue that the company is uniquely positioned to capture a large slice of the potential $100B+ total addressable market.

In this report, I will tell you how the company plans to do it. Their technology, business model, commercialization strategy, assess the opportunity, and conclude with a valuation model.

Let’s begin.

1. Business Model

2. Revenue Model

3. SpaceX Starlink

4. Finances

5. Valuation Model

6. Conclusion

1. Business Model

Probably most of us have been in a situation where we couldn’t make a phone call, send a message, or access the internet because of a weak connection.

Conventional wireless networks connect us using cell tower base stations. Each tower has a limited coverage radius in which devices can connect for their data to be transferred through the broader network. This is a very capital-intensive system that cost trillions of dollars to build and requires billions to maintain and expand.

This makes it unprofitable to build and maintain connections in remote areas with low economic activity. Furthermore, this network is vulnerable to disruptions during natural disasters.

AST Space Mobile (ASTS) is working to solve this problem by launching satellites that will connect directly to your smartphone, essentially placing cell towers in space.

If successful, the company could provide a cost-effective way to connect remote areas and provide emergency connectivity services to the government and military.

This is potentially a multi-hundred-billion-dollar opportunity!

This is why the company is trading for a $30.7B market cap, despite essentially no revenues.

Their shareholder base believes that there is a high probability of the company being that special, one out of ten thousand mega winners that VC investors dream about.

1.1. ASTS Satellites

While satellite communications have existed for decades, they have relied on large satellite receiver dishes.

These dishes would receive the data and then use local networks to transmit it to devices such as phones, TVs, or PCs. This is because ordinary devices don’t have an antenna strong enough to receive a signal from the satellite.

ASTS is attempting something novel by connecting satellites directly to the device, eliminating the need for a special receiver dish or antenna, thus simplifying the user experience and drastically increasing the total addressable market.

But there is a problem with this approach.

As we just established, for a device to receive a satellite signal directly, it needs specialized equipment with large antennas. This is costly and impractical for the general smartphone user. So, most consumers would not pay extra for a satellite-compatible device for the odd chance that someday they might need it. So instead of trying to change the device to receive a conventional satellite signal, ASTS had to reinvent the satellite.

Thus came the BlueBird program.

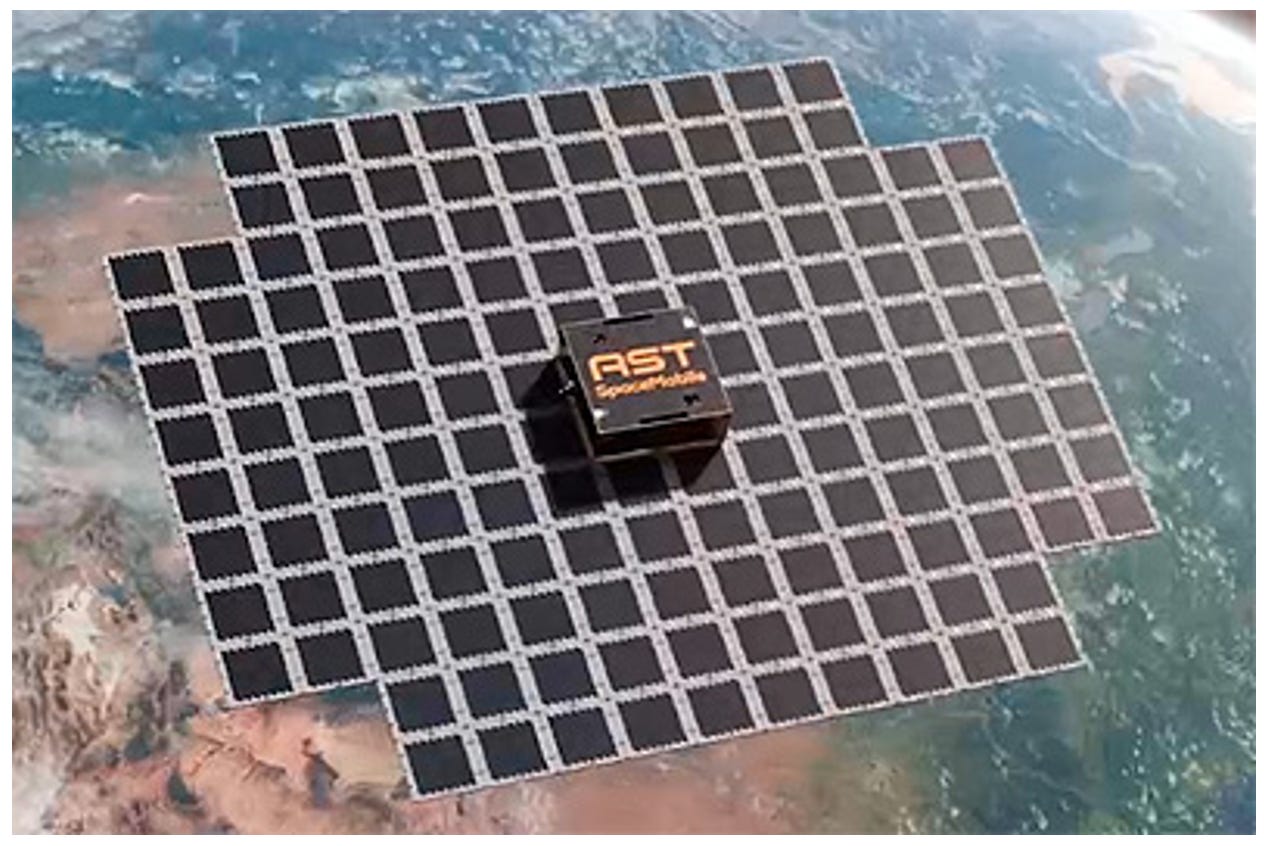

In the picture above, you see their phased array satellite. So instead of a small single antenna, BlueBird consists of thousands of tiny individual antenna elements, turning the satellite into a giant antenna.

On September 12, 2024, ASTS launched 5 BlueBird satellites, Block 1, to be used for testing.

Each of the Block 1 BlueBird satellites had an area of 64 square meters, many times larger than other satellites.

Furthermore, BlueBird satellites operate in the low-earth-orbit, about 500km above the Earth. This is significantly closer than the geostationary orbit of most communications satellites. The shorter distance reduces latency, enabling the satellite to facilitate live communication at much greater speeds.

So far, the results have been great, with ASTS completing various milestones such as video calls in the US, Europe, and Japan, achieving a peak data transfer speed of 120mbps.

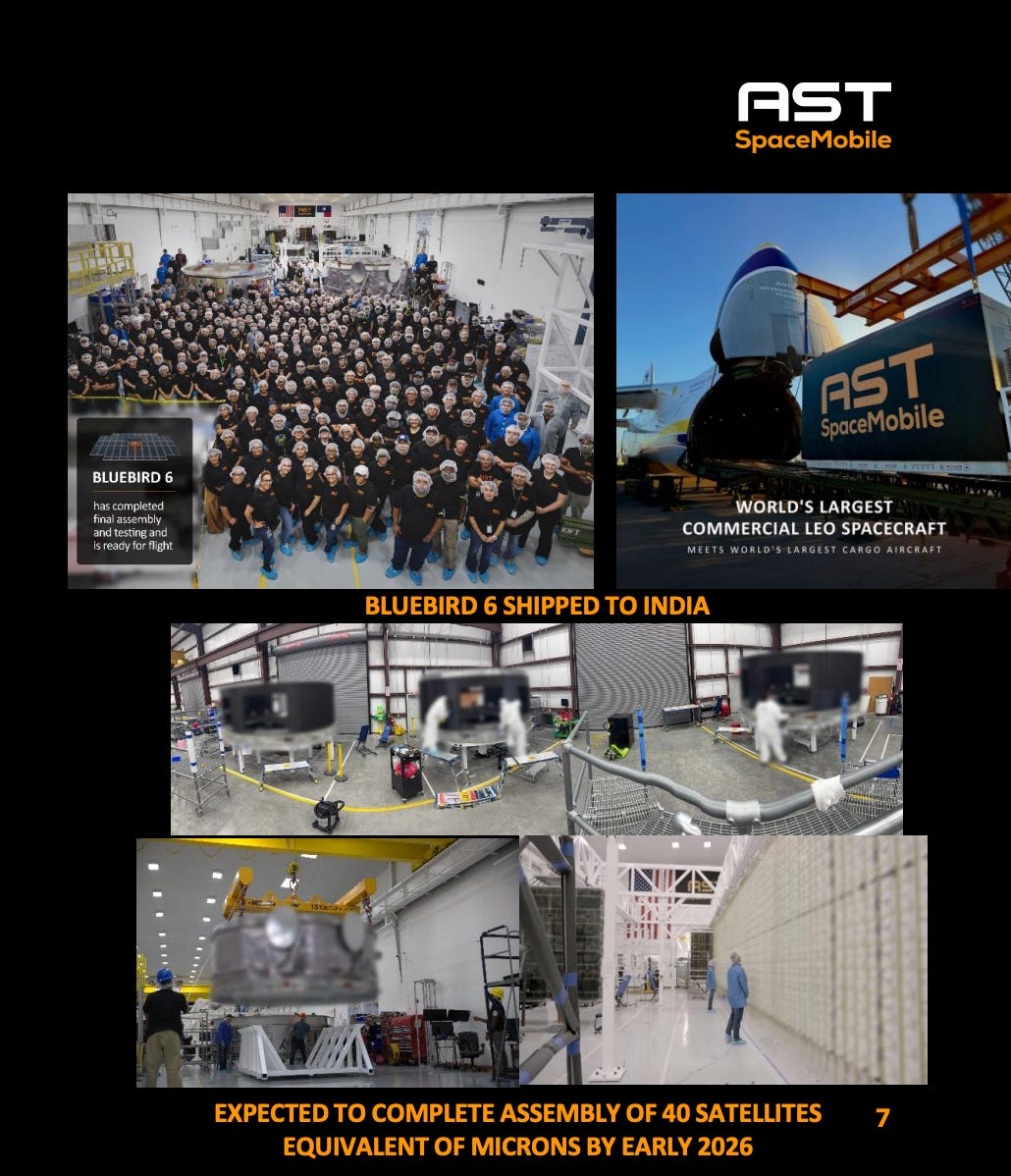

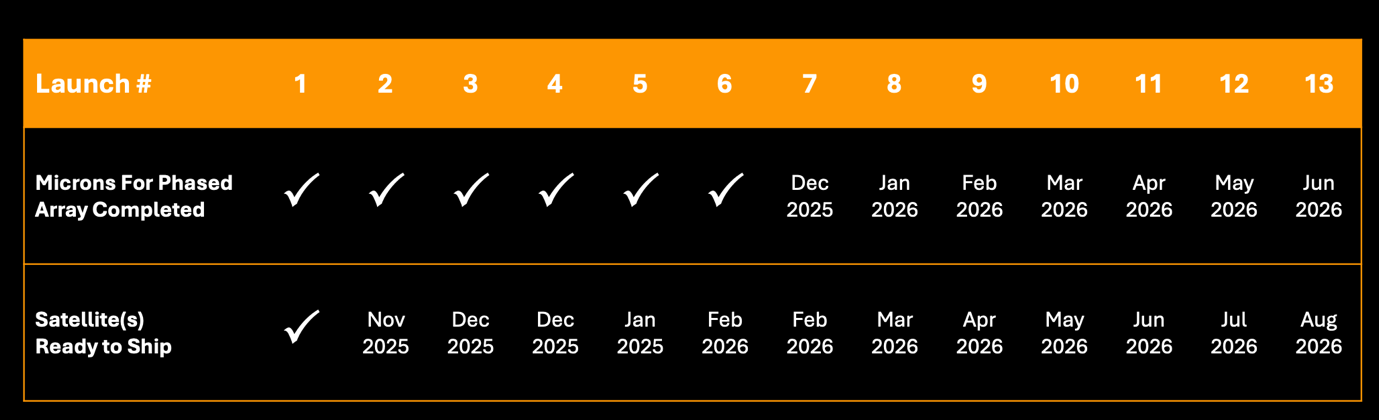

Thus, ASTS is preparing to launch Block 2 in a few days, on December 20, from India!

This launch will contain the next generation of BlueBird satellites, which are 3.5 times wider at around 223 square meters and are projected to have 10 times higher data capacity. This means significantly higher peak speeds, larger coverage area, higher reliability, and the ability to cover all required mobile network frequencies.

To achieve such an improved performance, the company had to overcome many technological challenges.

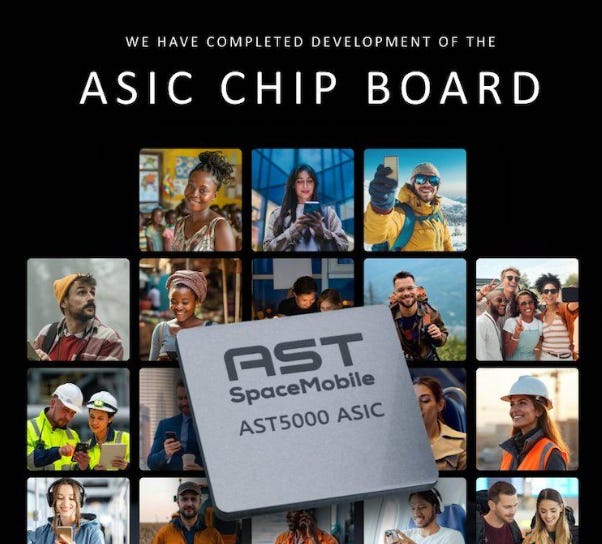

So, they developed a custom semiconductor application-specific integrated circuit (ASIC) chip, AST 5000.

AST 5000 ASIC enabled ASTS to:

Improve power efficiency

Reduce unit costs

Enable far greater data throughput

The company partnered with a semiconductor companies, Cadence, which helped with the design, and TSMC, to which AST outsourced the manufacturing.

This is a critical technological development that is a huge advantage over other satellite communication competitors, who tend to rely on commercially available chips for their satellites. The ASIC positions ASTS well against competitors whose offerings are primarily limited to emergency text or low-speed data services.

ASTS expects to have 45 to 60 satellites in orbit by the end of 2026, which will enable it to begin earning service revenues from its agreements with mobile network operators. The company aims to begin intermittent service activations in the US as soon as the first batch of satellites is online.

Further global activations are expected in 2026.

1.2. Commercial Business

A key difference with SpaceX is that from its very beginning, ASTS planned to be a direct-to-device connectivity partner to mobile network operators.

Simply put, ASTS has no plans to have a D2C consumer-facing business!

Instead of competing with Verizon, Orange, Vodafone, Bell Canada, Rakuten, and others, ASTS plans to work together with these companies.

Essentially, ASTS is a wholesale satellite connectivity provider to mobile network operators!

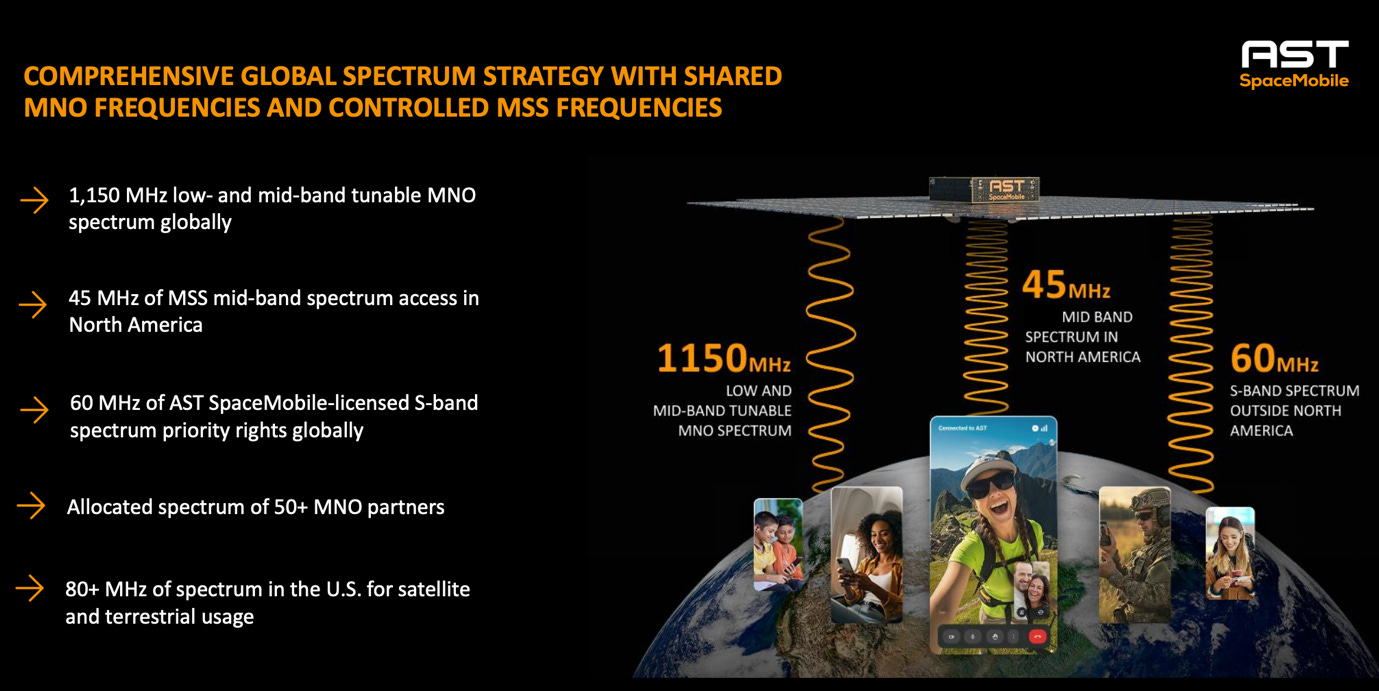

The way it works is that each carrier has government licenses to operate a mobile network using specific frequencies and bands.

Simply put, governments decide what each band and spectrum will be used for, and then they auction, assign, or license them to specific operators. This system is meant to keep communications networks stable and prevent different users of frequencies from interfering with one another.

ASTS has agreements with mobile network operators to use their licenses to serve clients in their exclusive frequencies.

These partners are building ground stations and gateways that will receive the signal from the ASTS satellites. So, a customer’s device directly connects to an ASTS satellite that then transmits the data to a mobile network ground station, which relays the data over its network.

The plan is for carriers such as Verizon to sell something like “enhanced connectivity packages” to its retail and business customers.

For example, a lumber company operating in rural Oregon could be interested in such a service. Their trucks and people often operate in the middle of nowhere, so the employees would appreciate a stronger signal to improve communication with HQ and their families.

Meanwhile, a retail customer might be interested in having a better connection while hiking or enhanced access in case of a natural disaster.

Verizon will serve these customers using ASTS, and both companies will share the additional revenues generated.

This business model is designed to accelerate global expansion and minimize customer acquisition costs. ASTS’ core competency is building and maintaining a satellite communications network, not retail customer acquisition and service.

Meanwhile, mobile network operators benefit by having a new premium service that can be offered to their customer base to generate higher revenue per user.

1.3. Government Business

In addition to people and businesses, governments have a strong interest in using the ASTS network to have better connectivity in remote areas.

There is an especially strong interest from the US military, which operates in some of the most remote areas of the world.

ASTS is an approved supplier to the US government, and the $18M in revenues the company has earned primarily relates to government business.

The company has agreements with US government entities such as the US Navy, Marines, Army, Space Command, and the Department of War.

ASTS services could be extremely useful in:

Direct to device communications

Weapons systems

Targeting systems

Transport systems

Secret missions behind enemy lines

Drones

Additional redundancy

Emergency systems

There is a massive earnings potential if ASTS were to become a major communications services supplier to the US and US allied militaries.

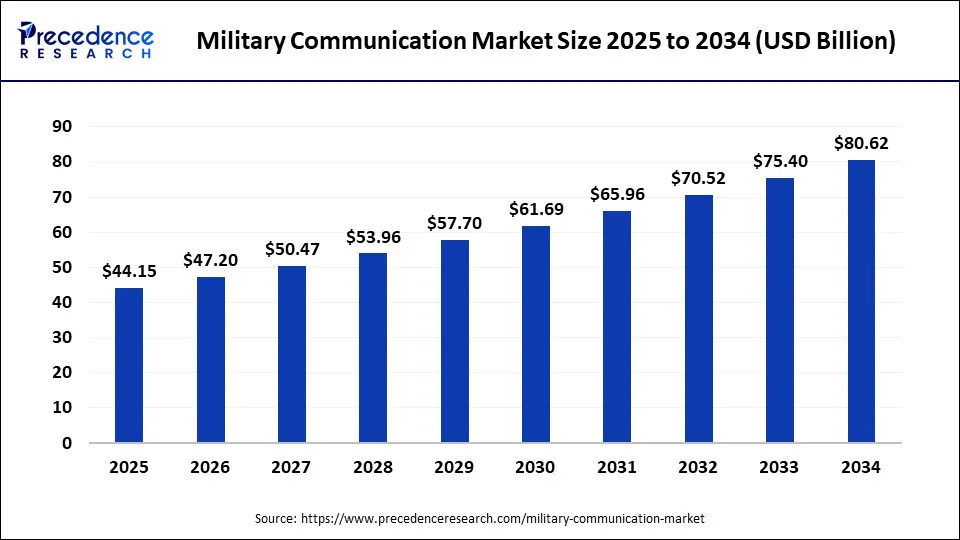

For example, Precedence Research estimates that the global military communications market generated sales of $44B in 2025. Furthermore, these researchers forecast that the industry will grow with a 6.92% CAGR to reach $80.6B in 2034.

While ASTS services are meant to address only a small subset of this industry, even generating a 1% market share would be an $860M revenue opportunity for ASTS in 2034.

It is hard to forecast a realistic market share, but if the technology works as intended, with no issues, they could generate billions from the military communications segment alone.

2. Revenue Model

Let’s discuss more specifically how exactly ASTS plans to earn revenues from this business.

ASTS has signed agreements with over 50 mobile network operators with over 3B subscribers!

These are long-term agreements, and ASTS services are in such demand that the company has secured significant contractual pre-payments. STC Group, the Saudi Arabia-based operator with clients across the Middle East and North Africa, agreed on a $175M pre-payment as part of a 10-year $1B agreement.

AT&T made a $20M pre-payment and agreed to a revenue share agreement till 2030. The specific revenue split has not been disclosed, but it likely heavily favors AT&T due to its stronger negotiating position and the technology of ASTS being yet unproven at such a scale.

Here are the most likely ways mobile service operators will monetize the service:

Monthly add-ons

Regional bundles

Day passes

Usage plans

IoT connectivity

Maritime connection

Aviation plans

Certain people or companies that spend a meaningful amount of time in areas with weak connectivity will select a monthly add-on for an extra price of $5-30 a month, depending on the country. Meanwhile, others will only subscribe to access a specific regional dead zone, and not for a broad overall coverage, paying a smaller add-on fee.

Day passes for $3-20 a day could be sold to those needing access for a short amount of time in a specific area.

Certain customers don’t know if and when they might need the service, but don’t want to be in a sticky situation without a connection. So, for them, plans that allow customers to pay per usage will also be an option. This would be similar to the early 2000s, when customers paid $1 per mb of data.

There are additional opportunities for monetization in the air and sea. ASTS could enter into partnerships with airlines or cruise ships to provide enhanced connectivity packages.

These prices are purely speculative and for illustrative purposes only. ASTS have yet to launch the network, so carriers are not rushing to release pricing. I could only find Bell Canada announcing a CA$10-15 surcharge for the full coverage plan, which would be $7-10.

3. SpaceX’s Starlink

Some of you reading are probably thinking, “What about SpaceX”?

SpaceX is Elon Musk’s world-famous rocket and space technology company with a satellite communications division, Starlink. They are a vertically integrated business that manufactures and launches their own rockets and satellites.

Both companies have chosen completely different strategies.

Firstly, Starlink is primarily an internet company. They have thousands of smaller satellites that provide high-speed internet service. Their satellites are much smaller than ASTS Block 2, because their objective is data speed, not coverage. Whilst ASTS’s objective for ASTS to improve connectivity in remote areas.

Secondly, Starlink is not a direct-to-device company, as its services require a satellite receiver dish. The company is developing a direct-to-device service, but it is behind ASTS in tech, as its satellites can only deliver low data services.

Third, while they have some partnerships, Starlink is a D2C brand that competes with mobile network operator internet divisions. This gives ASTS a scalability, distribution, and customer acquisition cost advantage. As a neutral player, it can piggyback on mobile operator client bases, without having to spend billions on marketing to acquire customers.

Lastly, I think the biggest difference is in their whole approach and philosophy to this industry. Starlink wants to be a standalone service that functions on its own, competing with and disrupting the world’s largest legacy mobile operators. Whilst ASTS is aiming to improve the service quality of existing networks in a cost-effective way.

However, while Starlink seems to be behind ASTS in the direct-to-device mobile service game, the company has ambitions to catch and overtake them.

A few months ago, the company announced a $17B deal to acquire a massive set of frequency licenses from EchoStar.

These licenses are directly meant for Starlink’s direct-to-device connectivity service, which could allow them to 20x the data throughput of the current Starlink mobile service satellite. This will empower them to compete directly with ASTS.

So, the competition is likely to intensify.

By their public actions, it is clear that Elon and Starlink view ASTS as a formidable competitor that could significantly reduce their future earnings. Elon has taken an unusually aggressive stance against ASTS.

Publicly accusing ASTS of safety gaps in a complaint to the FCC.

Said they are “littering the space with satellites”. A completely bizarre accusation, considering ASTS has launched only a few satellites and plans to launch fewer than 100, whilst SpaceX has thousands of satellites.

Accusing ASTS of being “subject to foreign control” due to European partnerships and ASTS working to establish a European control switch to comply with European regulations. Another bizarre complaint, accusing the company of being a national security risk to the US because of its dealings with Europe. Real nonsense stuff.

Making fun of ASTS’ valuation and calling it a MEME stock.

ASTS replied by accusing SpaceX of engaging in anti-competitive tactics and incendiary rhetoric.

These accusations clearly have no merit and are intended to slow ASTS down and potentially stop an emerging competitor.

4. Finances

While ASTS had sales of just $18.5M in the last 12 months, the company is on the cusp of launching its satellite service, which could bring in significant revenues.

ASTS has guided for revenues of $50-60M in 2025, but the real money is projected to come in 2026 and 2027, with analysts expecting revenues of $254M and $882M. Furthermore, ASTS is expected to have strong margins due to the business model it has chosen.

Essentially, through its revenue share agreements, ASTS will earn income without incurring high operating expenses.

SpaceX launches its own satellites, so it must incur the expensive development and launch costs. ASTS simply pays per launch. Furthermore, as already discussed, ASTS is not a D2C business, so it doesn’t need to acquire its own customers. This means no marketing, customer service, or administrative expenses. For context, Verizon spent $34.1B on SG&A in 2024, about 25% of revenues. Additionally, Verizon incurred a $17.9B depreciation expense related to the hundreds of billions of dollars they spent on building their network, around 13% of revenues.

Analysts expect 2027 EBITDA to reach $539M, a margin of 61%.

The 2027 net income is estimated to be $331M, a margin of 37%.

However, to achieve these margins, the company must spend billions in the next few years to establish the network. Satellite development, manufacturing, testing, and launching are extremely expensive.

Analysts expect ASTS to burn through $1.1B in FCF in 2025 and $1.7B in the next 2 years!

A reminder that the disconnect between FCF and profitability is caused by accounting rules. The cash is being spent today to create assets that will have productive lives for many years. Thus, accounting rules require companies to write off the purchased asset gradually over its useful life.

This means that ASTS will need to raise outside capital despite being profitable.

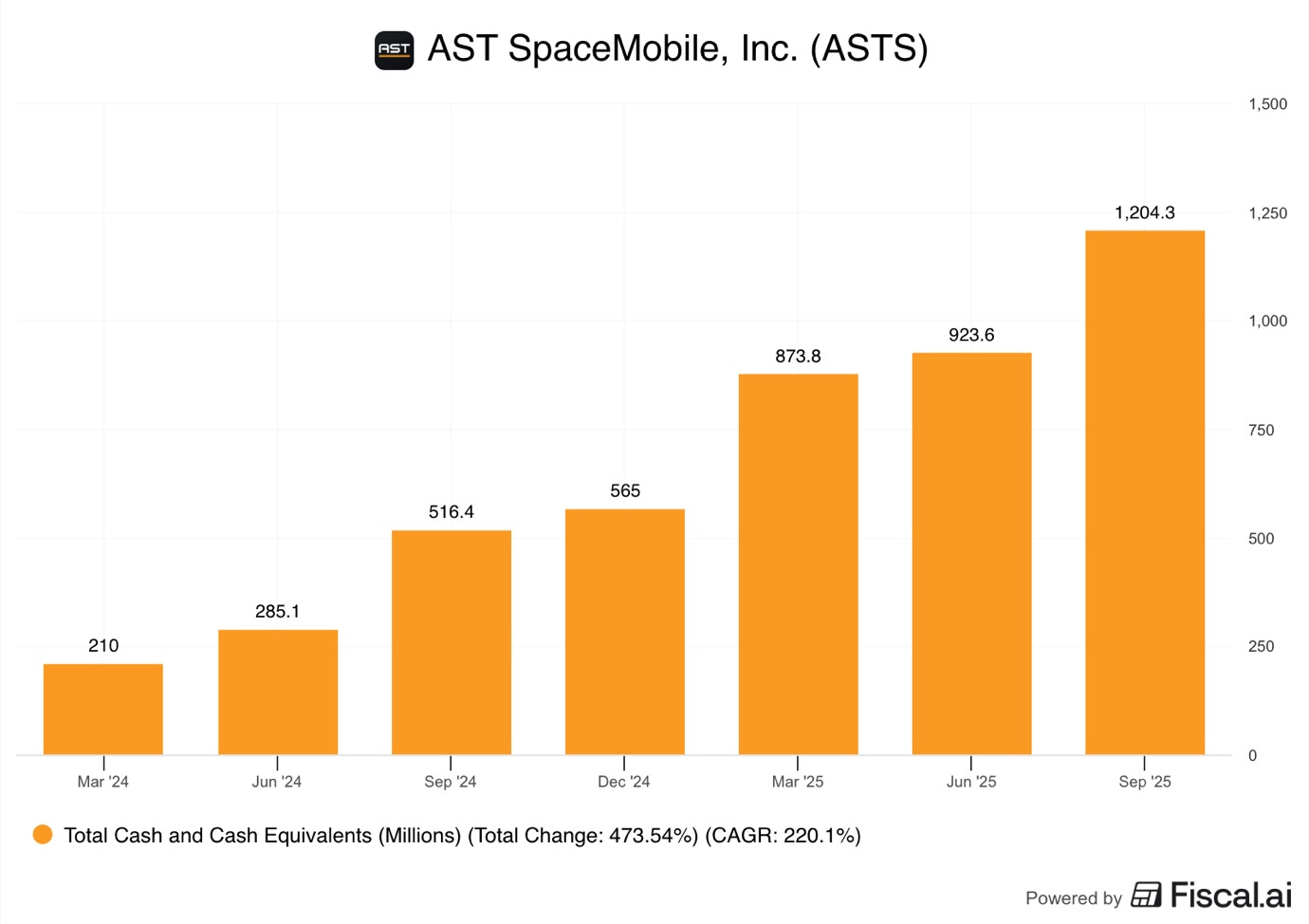

As of Q3 2025, ASTS has $1.2B of cash on its balance sheet, which is not enough to fund the $1.7B buildout costs in the next 2 years. This means that ASTS would need to raise at least $500M. But more likely ASTS needs $1-2B, as companies prefer to have a cash cushion and not delay the funding till the last moment.

Luckily, the company just did exactly that, raising $1.4B in October 2025, which will be reflected in Q4 numbers.

They issued a $1B convertible debt note and sold about $400M of stock.

As you can see in the chart above, they have been quite good at raising cash, with the cash balance increasing from $210M in Q1 2024 to $1.2B in Q3 2025. This is a net increase of $1B, despite them burning $1.1B in FCF during this time.

Including this raise, they could have close to $3B in cash in Q4!

This raise means that ASTS has enough liquidity for at least the next 2 years if analysts are right about the cash burn. This cushion positions them well to accelerate their launch plans, if the India launch goes according to plan.

5. Valuation Model

The reason why I call ASTS a VC-like opportunity is that the company can’t be valued based on conventional valuation metrics. With a market cap of $30.7B and revenues of $18.5M, the company trades for a P/S of 1,659.

Now, most public market investors would instantly turn around after seeing such a multiple, but for VC investors, this is a regular occurrence. They are used to investing in companies with very little or even no revenues.

The company needs to be valued based on its TAM and investor expectations on ASTS achieving that TAM.

Based on analyst 2027 estimates, ASTS trades for a P/S of 25 and a P/E of 49.

However, the problem with these estimates is that they are based on the assumption that the India launch succeeds. However, as always with new technologies, there are significant uncertainties.

What if the rocket explodes, destroying the satellites?

What if the satellites fail to deploy?

What if there are service quality issues?

What if the launch gets delayed?

What if supply chain issues delay the production of new satellites?

Depending on the severity of the issue, the monetization could be delayed by a month, 6 months, 1 year, or 3 years. In such a scenario, the long-term story might not change, but the short-term narrative could turn negative, pushing the stock down. This is a severe risk when investing in a speculative company trading at a very high valuation.

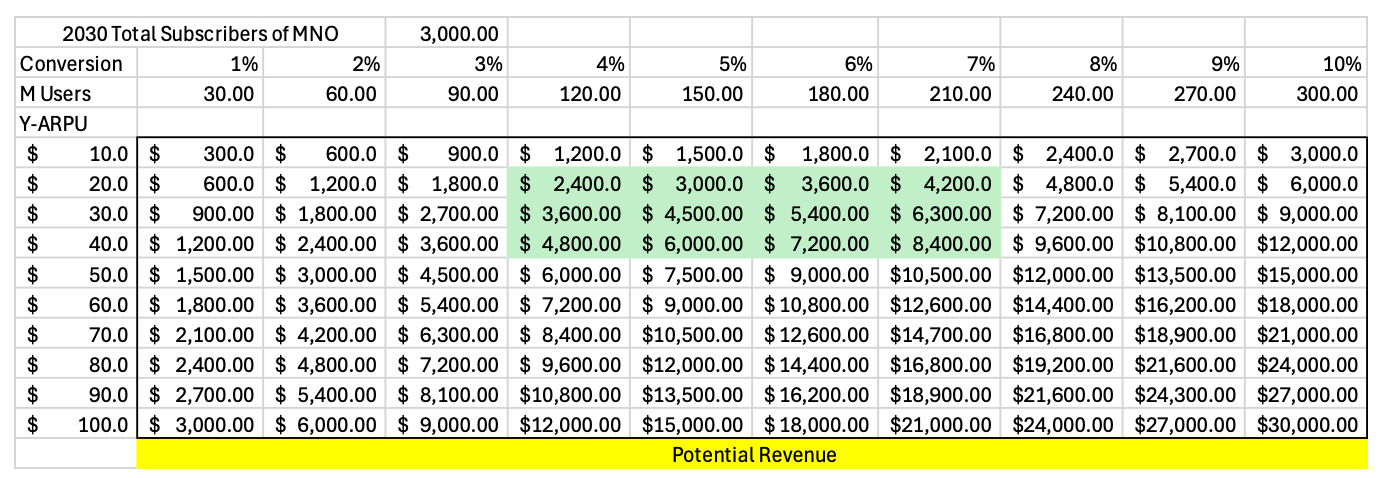

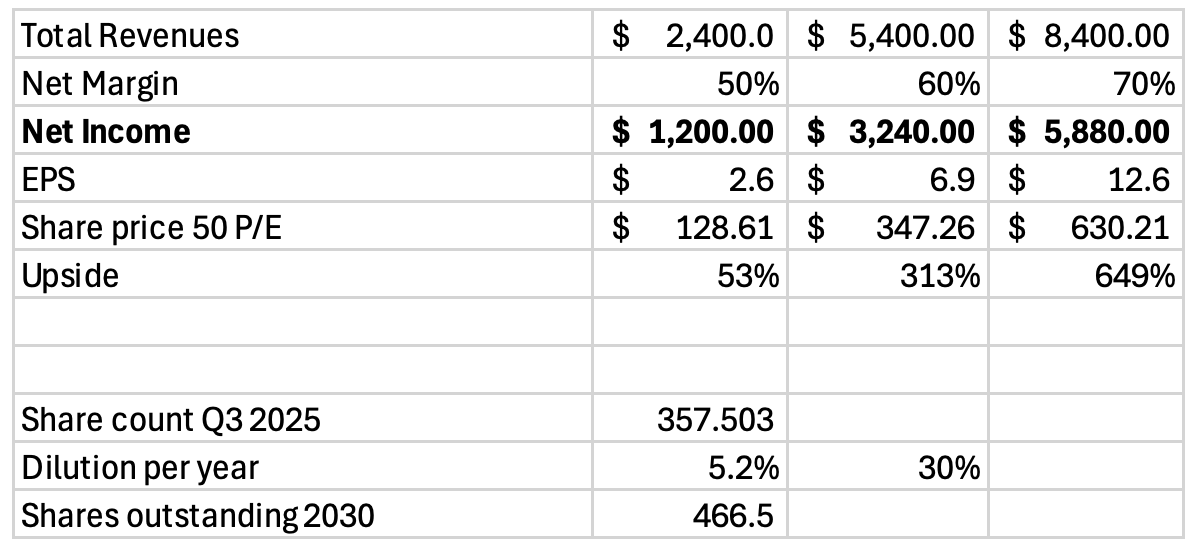

So, to value ASTS, I have made a scenario matrix below.

The company has agreements with mobile operators that have over 3B subscribers.

On top, I have placed conversion ratios from 1% to 10%.

On the left, I have placed the average net yearly ARPU per subscriber. This is ASTS cut after splitting the revenue with the mobile operator. ASTS is likely to keep around 40-60% of the revenue it generates. So, I use $10-100.

With 30M customers at $10 ARPU, the company would have revenues of $300M, whilst at the opposite end, 300M subscribers at a $100 ARPU would mean revenues of $30B.

Now the question is, where on this matrix will ASTS end up by 2030?

Realistically, while the US, Canada, and government subscribers could generate the $100 in ARPU, they won’t be the majority of ASTS’ customer base. The company will likely have millions of customers in India, the Middle East, Africa, and Indonesia. These customers don’t have the money to pay $10-20 a month.

So, I see the yearly ARPU being in the $20-40 range.

Meanwhile, in terms of the number of subscribers, I don’t see the adoption being very strong. Maybe I am biased, but I wouldn’t pay $40-80 extra a year for such a service. So I find it realistic that they have around 4-7% penetration.

That would lead to 120-210M customers.

Now we have a band of possible 2030 revenue outcomes that I have highlighted in green.

From $2.4B to $8.4B.

Next, profitability, at scale, ASTS could have a net margin of anywhere from 50-70%.

So net income could be anywhere from $1.2B to $5.9B!

Assuming about a 30% dilution by 2030 and an exit P/E of 50.

We get a possible share price of $128-630, an upside of 53-649%!

That is quite a big range, and where ASTS will end up depends on their execution, and there is a lot of work that needs to be done.

1. Satellites need to be built on schedule, without defects.

2. Launched without exploding.

3. Deployed in the right orbit.

4. Have the designed coverage and data speeds.

5. Handle network traffic.

This is the first phase. But even if ASTS completes all the steps, it still doesn’t guarantee success. Customers need to buy their services, and if ASTS mobile service partners fail to upsell the ASTS premium coverage upgrade, revenue could suffer.

Furthermore, there is the SpaceX question. With their recent $17B investment in licenses, the company has clearly positioned Starlink to be a major force in this industry.

6. Conclusion

In conclusion, ASTS is a very interesting, VC-like, high-risk, high-reward opportunity!

The company has developed innovative communication technologies that have the potential to reduce mobile network gaps and connect hundreds of millions of people. In just about a week, ASTS is taking the next step in its journey by launching its next-generation BlueBird satellites.

If successful, this would significantly de-risk the company, enabling it to go from testing to mass market!

ASTS has signed partnership agreements with mobile network operators that have 3 billion subscribers. Using the partnership model, ASTS is positioning itself to scale significantly faster than SpaceX’s Starlink.

Instead of spending billions of dollars on licenses and customer acquisition to compete against legacy providers, ASTS is aiming to become a default partner.

While analysts estimate 2027 revenues of $882M and EBITDA of $539M, that is fully dependent on launches going according to plan. Any delays could push these estimates out further in the future. As a volatile stock that’s valued on promises, not actual financial results, it is highly susceptible to any delays and bad news.

Nevertheless, as my valuation analysis showed, a successful execution promises strong returns. The company could have revenues anywhere from $2.4 to $8.4B, which could lead to earnings of $1.2-5.6B. Such a result could send the stock up many times.

However, significant uncertainty remains!

Personally, I am not comfortable investing in ASTS at such a valuation. Despite the promises, $30B is just too high for a company that has not proven itself on the mass market.

But I could see how this could work out for the investors, and I am perfectly aware that I could be missing out on the gains. I am comfortable with my portfolio and believe it is well-positioned to outperform the market.

The space race is in full swing, and I plan on covering more companies tackling this emerging frontier.

Learn how I structured my portfolio, past performance, current cost basis, and see my watch list.

Here is what my Premium Members can expect:

Portfolio Review - Each month, I will present the portfolio performance and discuss my stock watchlist and my best ideas.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Outstanding valuation framework here. The partnership model angle where ASTS piggybacks on mobile operators instead of burning capital on customer acquistion is probly their biggest edge. I worked ata startup that tried to compete head-on with incumbents and we ran out of cash, so seeing them take the B2B route makes a ton of sense for unit economics.

Good article 👍