Palantir Unclassified! Q1 2025 Earnings!

Huge US growth, Monster FCF, but slow International expansion!

While the whole stock market has a tantrum every time Trump says something new about trade, PLTR 0.00%↑ just continues to rise, with the stock up 49% YTD.

Just after earnings, Palantir reached a new all-time high market cap of $300B!

The earnings were indeed stunning! Revenue grew 39%, net income doubled, US customer count increased by 65%, whilst net dollar retention reached 124%!

However, investors were hoping for Palantir to significantly raise its guidance, as they didn’t, the stock fell, and now it’s down 9% in after-hours trading.

In this article, I will analyze Palantir’s Q1 of 2025, if you want to learn more about the business, I have written a full Deep Dive into the company!

Let’s look at the quarter in more detail!

1. US Commercial

2. US Government

3. US Revenue

4. International

5. Financials

6. Guidance

7. Valuation

8. Conclusion

1. US Commercial

In this segment, Palantir reports revenue from US-based corporations. For years, Palantir bulls have claimed that the commercial opportunity for Palantir is much larger than the governmental one. For investors to believe in this thesis, Palantir needed to deliver acceleration in growth, and they sure delivered.

In Q1 2025, the US Commercial revenue grew 70.3% Y/Y to $255M!

This is a significant acceleration from 40% growth in Q1 2024 and 63% in Q4 2024. Quarter on quarter, growth was an impressive 19%. The orange line in the above graph indicates this was the best result in 8 quarters.

Furthermore, if we look at the green line in the above graph, we see that Palantir delivered the best Y/Y US commercial growth rate in its history!

Palantir reported that the total contract value of this segment grew an astonishing 183% Y/Y to $810M, driven by a 100% increase in deals over $1M.

Such growth couldn’t be delivered if Palantir didn’t acquire new customers as quickly as they are. The company added 170 customers Y/Y and 50 Q/Q to reach 432 customers.

In the graph above, we see that Palantir has consistently grown its customer base by around 50% per year since Q4 2022!

Key points from the call:

“A large healthcare company did a boot camp with us in December and five weeks later converted to a five year, dollars twenty six million ACV enterprise agreement. A global bank started a pilot with us in Q4 2024, signed a $2,000,000 engagement a month later, then expanded to a three year nineteen million dollars ACV engagement four months after that. A Fortune 500 healthcare company began working with us in Q2 twenty twenty four and last quarter signed a five year, ten million ACV conversion deal.”Palantir Q1 2025 Earnings Call

2. US Government

Palantir’s software is used by many US government agencies such as the FBI, CIA, DoD, and more. Revenue from these government agencies is reported in this segment. Palantir’s bears have long stated that government growth is unsustainable, and Palantir will reach a ceiling soon. This quarter, Palantir again demonstrated that this narrative is incorrect.

This quarter, the US government revenue grew 45.3% to $373M!

Far from reaching a ceiling, Palantir’s US government revenue growth accelerated!

If we look at the green line in the above graph, we see that in Q1 2025, this segment delivered the best Y/Y growth in 11 quarters. Growth significantly reaccelerated from 12% in Q1 2024 and 44.7% in Q4 2024.

It seems that the TAM for the US government business is much larger than many analysts believed!

Key points from the call:

“Our US Government business continues to achieve impressive growth as we deliver towards the vital missions of the agencies we support. As the government focuses on efficiency, our commercially fielded battle hardened products stand alone. Last quarter, we closed deals expanding our work in the Department of Defense, including the critical impact we are delivering with Maven Smart System across the COCOMs and the services. The impact is far reaching.”Palantir Q1 2025 Earnings Call

3. US Revenue

Total US revenue grew 54.5% Y/Y to $628M!

Growth accelerated from 20.6% in Q1 2024 and 51.4% in Q4 2024.

Key points from the call:

“A Walgreens executive recently highlighted Foundry and AIP allowed them to play AI powered end to end workflows in 4,000 stores within eight months, automating what would have amounted to three eighty four billion decisions every day if relying on humans” Palantir Q1 2025 Earnings Call

4. International

While Palantir continues to execute in the US, the international segment underperforms.

International revenue grew just 12% Y/Y to $256M!

In the graph above, we see that the Q1 2025 growth of 12% was in line with Q4 2024, but much lower than 21% in Q1 2024.

If we compare US and International quarterly Y/Y growth rates, we see that the international segment has been heavily underperforming. The underperformance has been especially glaring since Q2 2024 and has increased every quarter since.

Key points from the call:

“Internationally, we closed a deal to provide Palantir Maven Smart System to NATO to deploy our AI mission command solution across its 32 member states” Palantir Q1 2025 Earnings Call

5. Financials

Overall, Palantir delivered strong financial results.

Revenue grew 39.3% Y/Y to $884M, operating income grew 117.7% to $176M, net income grew 171% to $214M, whilst FCF grew 139.5% to $304M!

The 39.3% revenue growth was a noticeable improvement from 20.8% in Q1 2024 and 36% in Q4 2024.

In the graph above, we can observe a steady revenue growth trend, as Q/Q growth has been positive every single quarter.

The green line shows the Y/Y revenue growth rate, which has been increasing every quarter since Q2 2023.

This performance is the result of Palantir gaining high-value customers, who keep signing ever larger deals.

Total Customers

In Q1 2025, Palantir gained 68 total customers, an increase of 8% Q/Q and 39% Y/Y!

AIP continues to be a huge driver for Palantir. A reminder that AIP is their AI platform product that enables organizations to essentially build a proprietary ChatGPT-like app. This local LLM is trained with an organization’s internal data, which is used to answer employee questions, saving time and resources.

Deals and Net Dollar Retention

Palantir doesn’t charge customers implementation costs, which is quite unique in the enterprise software industry. Palantir says that by not charging for implementation, they are incentivized to build more efficient customer acquisition and onboarding procedures.

This approach is starting to deliver great results, as in Q1 2025, they signed 139 deals of $1M+, 51 of which were for $5M+, and 31 for $10M+.

Compare this to Q1 2024, when 87 $1M+, 27 $5M+, and 15 $10M+ deals were signed.

This means that $1M+ deals grew by 60%, $5M+ by 89% and $10M+ by 107%!

Especially huge growth in large deals is a good sign, as these are the lower churn, higher profitability customers. I think it is quite likely that in the future, Palantir will stop disclosing $1M deals as they are increasingly irrelevant and begin disclosing $20M and $50M deals.

Net dollar retention measures how much existing customers spend with Palantir. In Q1 2025, NDR reached a multi-year record of 124%.

This means that if Palantir didn’t gain any new customers during the year, its Q1 2025 revenue would grow by 24% just from increased adoption of existing customers!

This means that from the 39.3% Y/Y revenue growth, 15.3% came from new customers.

This is an incredible customer retention!

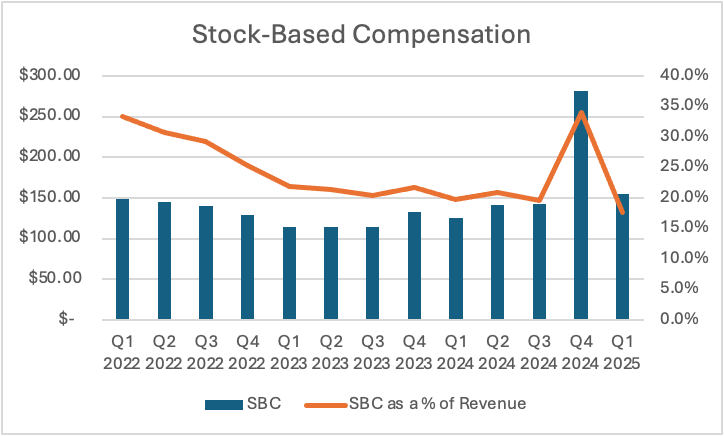

Stock-based Compensation

This quarter, Palantir spent $155M on SBC, up 24% Y/Y and 17.6% of total revenue!

In the graph above, we see that, barring the vesting of special employee stock awards in Q4 when Palantir’s stock reached certain goals, SBC has been going down as a share of revenue, and that is expected to continue.

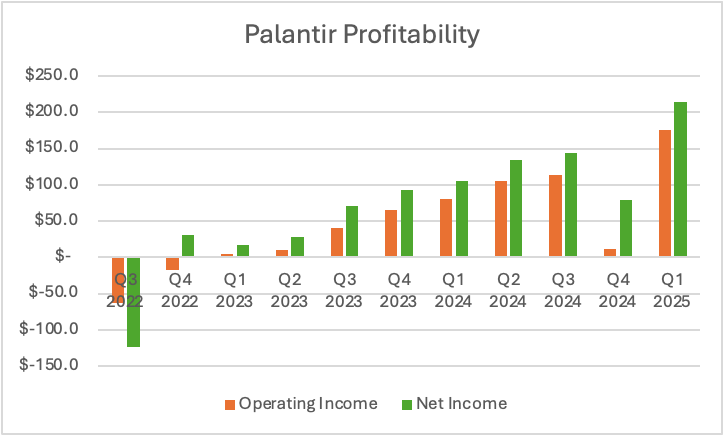

Profitability

Operating income grew a whopping 118% Y/Y to $176M, reaching a new record for the company. Operating margin increased from 12.8% to 20%. Driven by improved cost efficiency and smaller overhead, thanks to increased scale.

Net income jumped 171% to $214M, reaching a net income margin of 24%. Palantir’s net income is larger than operating income because of interest income that’s generated from Palantir’s $5.4B large cash pile.

FCF

Palantir is quickly becoming a cash-generating behemoth, delivering $370M in ADJ FCF, a margin of 42%.

This is a huge improvement from the 23% margin in Q1 2024.

Let’s remember that Palantir’s software model is a very scalable business, as it costs very little to sell an additional license, once the software is already developed.

As Palantir continues to grow and improve the efficiency of its operations, it is within the realm of possibility that it reaches a 50% FCF margin in the next few years.

6. Guidance

In the next quarter, Palantir expects revenues of around $936M, which would be an increase of 38%, below the 39% growth rate of Q1.

For the full 2025 year, the company expects to grow revenues by around 36% to $3.9B, a slight increase from the 31% growth it guided for in Q4 2024.

Palantir’s full year guidance implies that the company doesn’t expect to sustain the 39% growth rate of Q1.

I believe this is likely the reason for the 9% drop in the share price!

Investors were hoping that Palantir would raise its guidance significantly, thus they were disappointed.

The US commercial revenue guidance was raised from 54% to 68%, which is a huge increase. This again demonstrates that the international segment is the source of the weakness.

7. Valuation

While, without a shadow of a doubt, Palantir continues to deliver excellent financial results, unfortunately, the valuation has more than taken that into account.

With a market cap of $292B, Palantir trades for a TTM P/E of 512 and P/S of 94, which can only be described as insanity and a bubble!

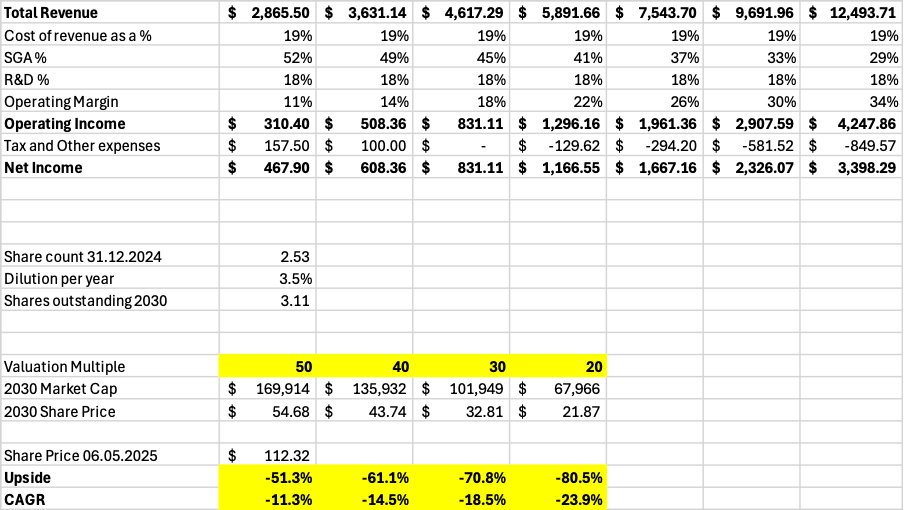

In my Palantir FY 2024 update, I created a Palantir valuation model. I am going to use the same model, but updated the current share price.

A full explanation of the model is available in my previous report!

Base Case:

In my Base Case scenario, I find a 51% to 80% downside to the Palantir stock!

Bull Case:

In my Bull Case scenario, I find between a 43% downside to a 42% upside!

As you can see in the tables, both cases imply huge revenue growth and improved profitability.

The valuation leaves very little upside, even in the most optimistic scenario, and a lot of downside if things don’t go perfectly!

8. Conclusion

Palantir is well-positioned to thrive in the volatile supply chain and macroeconomic environment created by Trump.

“Historically, in periods of turmoil, organizations both public and private have turned to Palantir. With the proliferation of AI, you see an even wider gap between the winners and losers. The winners won't be determined by size, but by adaptability. Many organizations are having to reimagine how their business does and should work in the future simply to survive. We are built to help companies embrace volatility.” Palantir Q1 2025 Earnings Call

As the quote from the earnings call points out, Palantir’s software is perfect for navigating massive disruptions, with AI at the core of their strategy.

Overall, the US commercial revenue segment grew faster than the US government segment, this is a strong indication that the commercial opportunity is indeed much larger than the governmental one.

However, international expansion continues to be slow!

There could be multiple reasons for it. It could be, as the bulls say, that the US opportunity is just so massive that Palantir has prioritized capturing it. International growth will accelerate when companies see the value that Palantir can deliver.

In the earnings call, the company essentially confirmed it and said that “Europe doesn’t get AI, but they will”.

With a P/E of 512 and P/S of close to 100, the international segment must accelerate to keep the stock up!

That is the fundamental issue, even if things go absolutely perfect and Palantir delivers 40%+ total revenue CAGR, the stock could still be flat.

However, you need even the tiniest thing to go wrong for the stock to fall extremely fast. If revenue growth goes below 30%, the stock could fall 50% or more!

I would like to congratulate those who are sitting on huge gains. Unfortunately, I don’t have an advice for you. The valuation can remain elevated for a long time, and it its entirely possible that the stock will keep rising.

However, in my opinion, it is more likely for the stock to come down hard in the next few years.

Unfortunately, I can’t tell when that will happen.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.